What is a Real Estate One-Time Showing Agreement? (2021)

Go Back To Previous PageImagine you’re selling your house for sale by the owner. You’ve been in contact with a real estate professional representing potential buyers. Therefore, a broker may send you a real estate One-Time Showing Agreement form. But you’re not a real estate broker or a lawyer, so seeing a document like this is daunting. To help you with that, we’ve included everything you need about a “One-Time Showing Agreement.”

you a real estate One-Time Showing Agreement form. But you’re not a real estate broker or a lawyer, so seeing a document like this is daunting. To help you with that, we’ve included everything you need about a “One-Time Showing Agreement.”

This way, they’re easy to understand. If a buyer’s broker sent you this document, it’s time to look at the details. Learn what it is before you sign it and send it back.

In this article, you’ll learn what they are, when and why brokers use them, and how they affect you as the seller. We will also discuss what you can expect to see in one to ensure that the one you’ve gotten is complete.

So, if you want to learn everything about the One-Time Showing Agreements form, let’s get started!

What is a One-Time Showing Agreement?

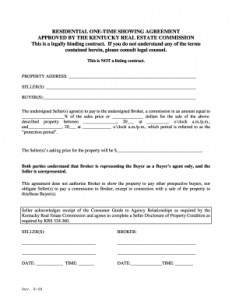

A One-Time Showing Agreement form is a legally binding agreement between the buyer’s broker and the homeowner listing the property for sale. In the document, the broker lists the names of people they plan to show the property to, and those buyers may submit an offer and purchase the property.

Under real estate laws, including the usual disclosure agreement, parties can execute this contract using electronic signatures.

The Agreement’s main point is that it ensures the seller will pay the broker’s commission if they sell the property to one of the buyers named within the contract Agreement.

A One-Time Showing Agreement form protects the buyer’s broker by ensuring a contractual agreement that the seller will pay them their commission if one of their clients purchases the home.

Let’s look at when brokers use them and how they work.

When is a One-Time Showing Agreement Used?

Brokers use “One Time Showing Agreements” when the property in question is off the Multiple Listing Service (MLS) and the homeowner is selling the home. This is because homes and properties listed in the MLS provide brokers representing homebuyers with their commission differently. As mentioned above, the Agreement ensures that the buyer’s broker will receive a commission on the sale.

home. This is because homes and properties listed in the MLS provide brokers representing homebuyers with their commission differently. As mentioned above, the Agreement ensures that the buyer’s broker will receive a commission on the sale.

This is because the contractual co-commission of homes listed in the MLS does not protect them.

We are not going into too much detail on the MLS or its workings. The MLS does not need a separate commission for homes listed.

This is due to the agreements within the MLS. Brokers do not use “One-Time Showing Agreements” for those properties.

Does the Seller Still Have to Pay the Broker’s Commission?

The short answer is yes. The seller still has to pay the buyer’s commission, but technically, the seller doesn’t have to pay the commission for the buyer’s broker if they don’t want to agree to the One-Time Showing Agreement. Sometimes, the seller will negotiate with two buyers simultaneously.

But then, good luck getting any brokers to show your house to potential buyers, as buyers rarely agree to pay their own broker’s commission.

Sign here with a word on business documents, eyeglasses, and a ballpoint pen. The signature or agreement concept

Most homes (over 95%) are listed for sale using a broker or within the MLS. Both methods involve the seller paying the broker’s commission.

So, if a seller decides to list their home for sale by owner, no contractual co-broker agreement ensures both brokers will receive their commission. This is why people use One-Time Showing Agreements, and the seller signs the document in the Agreement to pay the buyer’s broker’s commission.

Without the seller signing a real estate “One-Time Showing Agreement” and agreeing to pay the broker’s commission, the broker has no incentive to show buyers’ property.

Without brokers showing the property to buyers, the seller will struggle to find a buyer quickly. Brokers need a contract to ensure they will get paid.

The seller must pay the broker’s commission with a One-Time Showing Agreement!

What You Might See in a One-Time Showing Agreement

A One-Time Showing Agreement is a commission agreement signed between a broker representing a buyer and a homeowner. It is used when a property is not listed in the MLS (Multiple Listing Service). Properties in the MLS have a contractual co-broke commission, meaning no separate commission agreement is typically required when showing a home listed in the MLS.

Brokers draft the Agreement from their standpoint, and the real estate agents and brokers point toward the seller. It will start by addressing you as the seller before naming themselves (brokerage and listing agent) and mentioning the Agreement’s name (One Time Showing Agreement) within the introduction. After that, you will see the typical legal jargon you would expect to see in any contractual agreement.

What does this Agreement describe?

One Agreement may slightly differ from another in terms of the exact wording. Some general topics are recurrent. The most important aspect is that it lists the names of potential buyers to whom the broker plans to show the property.

The Agreement might also indicate that it also applies to any other explicitly related people who may purchase the property. Continuing, you’ll have to recognize the expected things, such as:

- Who the registered property owner is, and who has the authorization to sell the property

- Acceptance of the dates during which the real estate One Time Showing Agreement is effective

- Authorizing them to show the property at the agreed-upon price

- And, of course, agreeing to pay the broker’s commission

Again, you may find different information and likely more legal jargon and disclosures within the Agreement. However, these are the things that you’ll almost definitely see within a “One Time Showing Agreement”! Given our years of experience, we have negotiated quite a few of them.