Buying a co-op in NYC (2023)

Go Back To Previous PageIs it worth buying a coop in NYC? Buying a coop in NYC can be tricky. It takes longer and requires more steps than buying a condo, so it’s advisable to plan. Here’s what you need to know. Co-op apartments make up approximately two-thirds of the housing stock in NYC. Therefore, if you plan on buying a place in the city, you’ll likely encounter co-ops. Co-ops are also more affordable than comparable condos or single-family homes since it’s harder for foreigners and investors to purchase co-op buildings. So what exactly are they? How much do they cost? And how do you buy one? This guide will cover everything you need to know about buying a coop in NYC, including the pros and cons, as well as key questions to ask when purchasing a coop in NYC.

What does it mean to buy a coop in NYC?

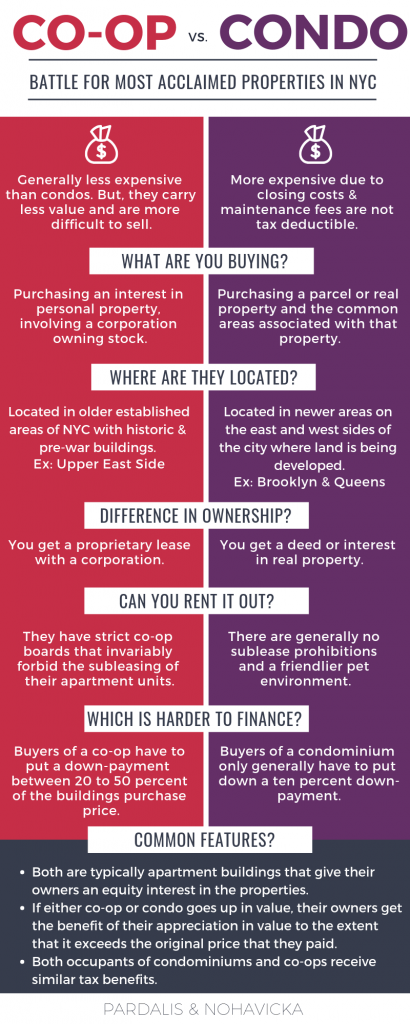

A coop is not “real property,” so when you buy a coop in NYC, it means you’re buying shares of a corporation. These shares come with a proprietary lease that grants you the right to occupy the apartment. New York City coops are also well known for their notoriously strict coop boards, which can deny a buyer for any reason. This can make it more complicated to buy or sell a co-op apartment.

This type of ownership has numerous implications. You won’t receive a deed; you’ll hold stock in the cooperative corporation. This also means that financing a coop will work differently.

You’ll get a co-op loan, and the application requirements are typically more stringent than those for a traditional mortgage on a condo or townhouse.

While this may sound like a drawback, you’ll enjoy the associated benefit of not having to pay the NYC mortgage recording tax. This is one reason coop closing costs are generally significantly lower than condo closing costs in New York City.

How long does it take to buy a coop in NYC?

Once you’ve found a place you want to buy, it typically takes between 6 and 12 weeks to close on a coop in NYC. The exact time will depend on the property and whether you’re making an all-cash purchase or financing. All-cash buyers can expect to close in as little as 6-10 weeks.

buyers can expect to close in as little as 6-10 weeks.

If you’re financing the Coop, you can expect it to take 8-12 weeks. Remember that you’ll still need to budget some time to find a place, which can often be the most time-consuming part of the buying process. Additionally, the timeline can be delayed if an issue arises during the purchase process.

Is buying a coop a good investment?

Buying a coop can be a good investment under certain circumstances, as New York City’s real estate has been on an upward trend in recent years. That means if you plan to buy a coop and live in it for an extended period, it will likely appreciate and prove to be a good investment.

With that in mind, co-ops are not typically as attractive to investors as condos, as they can be harder to sell, have more restrictions on subletting, and have a flip tax.

What does a co-op’s maintenance fee cover?

A co-op’s maintenance fee combines property taxes and standard charges into a single monthly payment. In contrast, a condo owner receives separate bills for each expense.

Typically, the maintenance fee is divided equally between property taxes and common charges. At the end of each year, co-op owners receive a form from management that details their share of the building’s property taxes.

Common charges cover the essential services required to operate the building, such as paying the doormen, maintaining the hallways, and disposing of the garbage. Additionally, maintenance fees may also include funds for planned capital improvements, like repainting the hallways or renovating the lobby.

What is an assessment?

Every cooperative (co-op) has a reserve fund, which can be thought of as the building’s checking account. This fund is used to cover day-to-day expenses and includes additional funds for unexpected costs. However, there are times when the reserve fund may not have enough to cover these expenses.

For instance, if the roof leaks, it needs to be repaired immediately, and roof repairs can be costly. If the reserve fund falls short, most co-ops will issue an “assessment.” This means an additional charge is added to each shareholder’s maintenance bill. Typically, assessments are conducted for specific reasons (such as roof repair) and have a defined duration. Once the associated expense is fully paid, the assessment ends.

Assessments can also be used for optional projects, such as renovating the hallways.

Pros and cons of buying a coop in NYC

When deciding whether to buy a coop, it is essential to weigh the pros and cons. There are numerous advantages to buying a coop, but there are also some downsides.

In short, the most significant pros of buying a coop are affordability, while the cons are related to less convenience and flexibility compared to condos. Here’s what you’ll want to consider.

Coop Pros

- Co-ops are generally cheaper than condos.

- Closing costs are typically lower than those for condos.

- Most coop buildings are majority owner-occupied, meaning you won’t have a constant revolving door of new neighbors.

Coop Cons

- Buying and selling a coop is typically more complicated due to the stricter board approval process. (debt-to-income ratio, post-closing liquidity)

- Co-op buildings often have restrictions regarding activities such as subletting.

- Co-ops may have stricter house rules regarding in-unit laundry.

- Co-ops may have flip taxes to discourage investors from flipping apartments in the building.

Steps to Buying a Co-op

Here are the steps you’ll need to take to buy a coop in New York City:

- Figure out your budget and get preapproved

- Decide on a neighborhood.

- Hire a broker and start your search

- Submit your offer and negotiate a deal

- Sign the contract

- Submit the board application

- Close the deal

Questions to ask when buying a coop

Because cooperative buildings have more restrictive house rules than condominiums, you’ll want to know what you’re getting into before purchasing. Here are some critical questions to ask when buying a coop.

- What is the sublet policy? NYC co-ops often have restrictive subletting policies, so if you plan on moving away and subletting the apartment, you’ll want to ensure the building allows it.

- Is there a flip tax? Note that it includes what it costs and who is responsible for paying it.

- How much have maintenance fees risen in the past five years? You want to ensure you’re buying in a well-managed building, and a great way to gauge this is by examining the level of maintenance required. If maintenance increases by a few percentage points each year, that’s acceptable, but if it jumps by close to double digits, that’s a red flag.

- How are the building’s financials? You want to ensure the coop building you’re buying has good financials and a healthy reserve fund. The last thing you want to worry about is unexpected assessments.

- What is the deal with air rights?

- When buying a coop, you’ll want to know that the building is in good condition. What condition are the roof, facade, boilers, and elevators in? If it needs repairs, the reserve fund may be depleted, and you may have to pay additional fees or experience increased maintenance costs.

- Is there a land lease? While buying a coop in a land-lease building might seem attractive initially, the low selling prices are rarely worth it in the long run, as land-lease buildings have incredibly high maintenance fees.

- Do I have to pay for title insurance to buy that given Co-op?