How to Reduce Your DTI Ratio When Buying a NYC Co-op

Go Back To Previous PageNew York City has an incredible array of living situations. One of the most popular is Co-ops. Co-ops are in vogue among the ultra-rich in the Big Apple, so some became status symbols. Unsurprisingly, co-ops are remarkably choosy in who lives there. They’re particularly picky regarding your financial health, so your DTI ratio could come into play. You need to reduce your DTI, also known as your debt-to-income ratio, to get the best possible results. The lower your DTI ratio for mortgage or co-op, the better your chances of getting the co-op you want. The question is, how can you get that to drop low? We will highlight various DTI ratio calculators.

the Big Apple, so some became status symbols. Unsurprisingly, co-ops are remarkably choosy in who lives there. They’re particularly picky regarding your financial health, so your DTI ratio could come into play. You need to reduce your DTI, also known as your debt-to-income ratio, to get the best possible results. The lower your DTI ratio for mortgage or co-op, the better your chances of getting the co-op you want. The question is, how can you get that to drop low? We will highlight various DTI ratio calculators.

Some strict co-ops in NYC have a zero-tolerance policy for Debt-to-Income ratios above their threshold. This means you’ll get a rejection for having a DTI of just 30.10% if the building requires less than 30%. Fortunately, there are ways to structure your co-op offer to reduce your DTI and maximize the chances of board approval. The buyer can receive a gift, raise a down payment, find a lower interest rate, change a loan product, etc.

What Is A DTI Ratio?

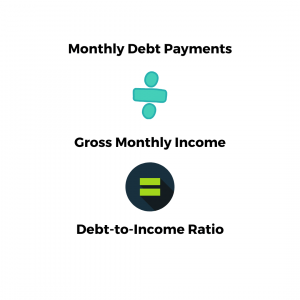

A debt-to-income ratio compares your monthly debts to your gross monthly income. More specifically, DTI measures the total debt you must pay each month divided by the full payment you get every month (before taking out taxes). So, the general equation looks like this:

(Total Debt You Pay Monthly) ÷ (Amount You Get Paid Before Taxes) = DTI

This gives you a percentage of your total debt payments for your bills. If your DTI is too high, lenders worry you will not make your monthly debt payments. That said, there’s a little more to DTIs than the general equation. This calculation is highlighted in the REBNY statement provided.

What Are Front-End And Back-End DTIs?

There are two different ways to calculate how much debt you have, and these terms refer to the two main methods lenders use to calculate DTIs. You’ll usually see them in the paperwork marked by (Front-End/Back-End) markings. The equations below will give you a better idea of how each calculation works:

1) The Front-End Equation of the DTI Ratio

(Total You Pay For Your Housing, i.e., Rent or PITI) ÷ (Amount You Get Paid Before Taxes) = Front-End DTI

As this equation shows, the front-end DTI is about how much you spend on housing. If you’re renting, you will put down your rent. On the other hand, homeowners will need to put down their PITI. PITI includes your mortgage principal and insurance, your property taxes, and any HOA fees you have.

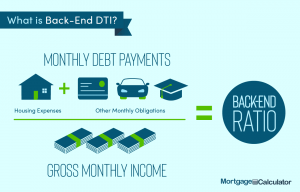

2) The Back-End Equation of the DTI Ratio

(Total Monthly Debts You Pay, Including Housing) ÷ (Amount You Get Paid Before Taxes) = Back-End DTI

Back-end DTIs are the more judgmental type of DTI. This calculation will involve all your debts, including your housing. So, for your back- end DTI, you will also have to include car payments, credit card payments, and monthly loans for personal reasons and any lines of credit.

end DTI, you will also have to include car payments, credit card payments, and monthly loans for personal reasons and any lines of credit.

Your real estate agent can help enlighten you on anything else to include.

What Is A Good DTI Ratio for New York Real Estate?

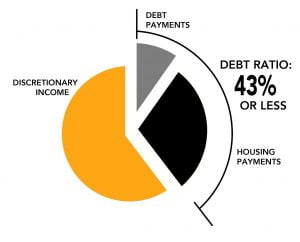

The lower your DTI, the better. In theory, getting approved for a home loan in New York City with a debt-to-income ratio higher than 49 percent is possible. Most lenders want applicants with a 28/36 DTI ratio or less.

The lower your DTI, the higher your chance of getting a mortgage amenable to you. Between 37 and 49 percent, banks will consider your DTI pretty rough. In this range, you might be able to get approved, but most lenders will consider you a risk. Therefore, you might face several rejections before reaching your desired home loan.

How Can I Lower My DTI Ratio Fast?

Lowering your DTI ratio should be a marathon, not a sprint. The longer you prepare, the better your results will be. That said, there are several ways to improve your DTI ratio for your home purchase.

- Pay down your credit cards fast. Do whatever you can to increase the amount you pay monthly on your credit card bills. The less credit card debt you have, the lower your DTI will be; this is the fastest way to make things happen.

- Consider paying down your car early. If you have that option, it’s a good idea to consider it as long as it doesn’t kick in fees.

- Postpone large purchases that you’d typically do on credit. It may feel good to have a new fridge right now, but it’s better to wait until

you get the housing situation under control.

you get the housing situation under control. - Don’t add to your debt. Yes, your favorite store has a once-in-a-lifetime sale, but it’s not worth wrecking your DTI. Even small purchases (like a pair of $100 shoes) can add up fast and skew your DTI to the higher numbers.

- Consider applying for a specialty loan. For example, FHA and VA loans are reasonably amenable to people with higher DTI because they target first-time buyers or people with particular circumstances.

- Ask for a raise or start a side gig. You might not like driving for Uber or asking your boss for a raise, but it’s a good idea. While lowering debt is often easier, sometimes, the best thing you can do is increase your income. Besides, that can help you pay down debts if you’re lucky.

What Factors Can Mitigate A High DTI Ratio?

Having a high DTI remains a common reason for lenders to reject you. However, the truth is that it doesn’t have to be a death sentence. There are several things that you can do to improve your chances, and these factors below make a significant impact on what lenders decide to do with your application:

1) A Good Credit Score as a low DTI mitigant ratio for the bank

More specifically, having a FICO score above 700 increases your chances of approval. Ideally, it’ll be above 720, as determined by credit scoring models. The higher, the better. You can also fix your credit, so it’s pretty easy.

higher, the better. You can also fix your credit, so it’s pretty easy.

Your credit score ranges from 300 to 850 and is impacted by your credit history.

2) A High Down Payment.

If you have a high down payment (as a percentage of the purchase price), most lenders will be far more forgiving with your DTI. It’s generally the most significant factor in approval algorithms. Increasing the size of your down payment is the most direct way to reduce your monthly mortgage payment and DTI.

This strategy is challenging since most co-ops in NYC require at least 20% down and much more. Furthermore, you may only increase the size of your down payment if it does not adversely impact your post-closing liquidity. Most co-ops in NYC require applicants to have one to two years of monthly housing expenses in liquid assets after the down payment and closing costs.

3) Mortgage Insurance.

Paying private mortgage insurance (PMI) or being open to it is an excellent way to get better chances with banks.

4) Lower your interest rate.

You can lower your Debt-to-Income ratio simply by finding a lender who offers a better interest rate. In the example below, reducing the interest rate from 3.75% to 3.60% significantly affects the monthly mortgage payment, reducing the applicant’s DTI below the 25% threshold. Your interest rate is not locked in until you’ve signed a purchase contract and applied for financing.

5) Change mortgage products or terms.

For instance, switching from a 30-year fixed mortgage to a 5/1 ARM with a lower interest rate or an Interest-Only mortgage will reduce your DTI. It reduces your monthly mortgage payment. The challenge is that some Co-op buildings have prohibitions on ARM mortgages. Other co-ops permit ARM mortgages subject to your DTI passing a stress test based on the monthly payment using the highest possible interest rate under the loan terms.

6) Business Income.

Knowing the full details of the business’s income can sometimes sway specific lenders if you own a company you pay yourself through. However, this usually only works if you use (at least partially) the real estate you want to buy for commercial work.

7) Get a Co-Purchaser or Guarantor

You can apply with a guarantor or co-purchase the unit with a family member. Both options allow the purchaser to leverage the income of the other applicant to meet the co-op’s DTI ratio requirement. However, each Co-op building has its own rules on co-purchasing and guarantors.

Therefore, it’s important to strategize with your broker on the structure you envision before signing a contract and submitting an initial offer.

When Should You Talk To Your Real Estate Agent?

Suppose you feel lost about your DTI and loan qualifications; you’re not alone. However, help is always a phone call away, and an excellent real estate agent or broker can help you plan things out. So, whenever you feel overwhelmed with your transaction, call your NestApple.