What is a private mortgage insurance on mortgage in NYC?

Go Back To Previous PageWhen you first apply for financing during your real estate purchase, you will hear many different terms. Along with the various loan types (ARM, conventional, FHA, VA), you may also listen to whispers about mortgage insurance. If you get mortgage insurance, you may wonder what it is and why it’s there. In New York, everyone is familiar with putting down 20% of the property’s purchase price. However, most are unfamiliar with the fact that private mortgage insurance (PMI) on a mortgage remains an option for those who can’t come up with the 20% upfront. Who pays for private mortgage insurance on a mortgage? How much is private mortgage insurance on an FHA loan? Can I deduct private mortgage insurance on tax?

mortgage remains an option for those who can’t come up with the 20% upfront. Who pays for private mortgage insurance on a mortgage? How much is private mortgage insurance on an FHA loan? Can I deduct private mortgage insurance on tax?

What Is Mortgage Insurance?

Mortgage insurance is a form of insurance required by bankers. It is paid to ensure that bankers can recover some costs if the mortgage borrower defaults on the loan.

People who do not have a high down payment will have to pay mortgage insurance in traditional loans.

Mortgage insurance is a specialty insurance policy lenders often require borrowers to obtain as part of their loan stipulation. This insurance protects and reimburses your lender if you cannot repay your loan.

It’s a form of loss prevention that can also help banks fund the legal fees required to start a foreclosure process.

What is PMI Payment?

- A borrower buys Private Mortgage Insurance (PMI) to protect the lender in the case of a missed payment.

- This insurance remains required for a conventional loan with less than 20% down.

- PMI costs range from 0.5% to 1% of the loan amount.

- Payments are usually monthly.

- You can stop PMI payments once the bank’s requirements are satisfied. It usually means 78% of your principal is paid off, assuming no late or missed payments.

- PMI remains a good fit for you because you can keep more liquid assets instead of putting 20% down, assuming you have enough income to make higher monthly loan payments.

Who pays for private mortgage insurance on a mortgage?

The borrower pays for it.

What is PMI?

A PMI, known as private mortgage insurance, protects the bank if you stop paying back your mortgage. Lenders require this from buyers whose loan is over 80% of the property value—purchasers who cannot or do not want to put 20% down to purchase a PMI.

property value—purchasers who cannot or do not want to put 20% down to purchase a PMI.

It is a riskier loan for the bank. The bank will disclose your monthly PMI in either your loan estimate or the closing documents.

What is the Cost of PMI (Private Mortgage Insurance on Mortgage)?

How much is private mortgage insurance on an FHA loan? It ranges from 0.5% to 1% of the loan amount yearly, depending on your credit score. For example, if you have a 1% PMI fee on a $500,000 loan, you would pay an extra $5,000 a year or $416 a month on the regular mortgage payments, and the cost gets added to your regular monthly mortgage payment.

However, borrowers can also purchase a single PMI, paid as part of the closing costs, or financed into the loan. Not all banks allow that format.

The cost of PMI depends on several factors:

- Size of the mortgage.

- Downpayment amount. The higher the down payment is, the lower the PMI.

- FICO score. PMI will cost more if you have a lower FICO.

- Type of mortgage. PMI may cost more if you have an ARM because it’s riskier.

- Your Loan-to-Value Ratio (LTV).

Do All Loans Require Mortgage Insurance?

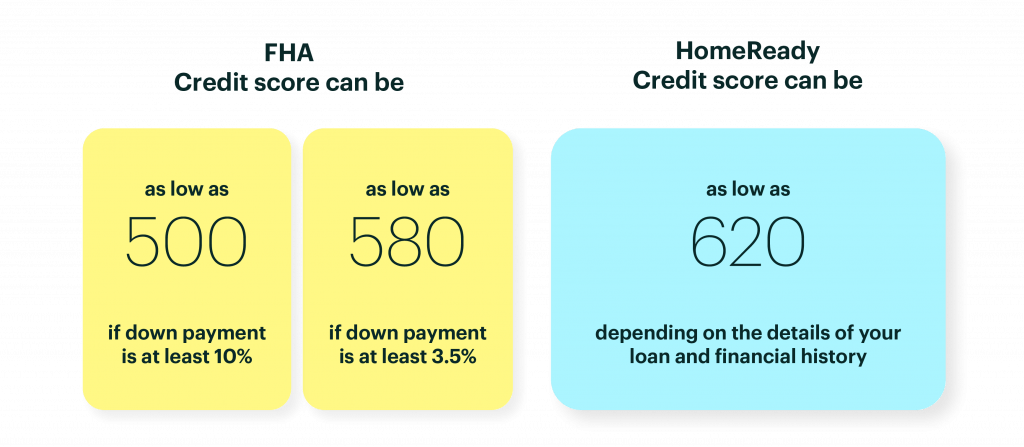

Not all home loans require mortgage insurance. It all depends on how much of a down payment you have, your credit score, and other risk factors. Moreover, certain types of mortgages will require insurance regardless of who applies. Here’s what you need to be aware of with each significant type:

FHA/USDA Loans

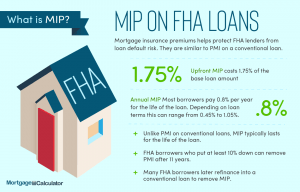

These loans will always require mortgage insurance, regardless of the down payment. This upfront cost will come as part of your closing costs and, in most cases, will be paid directly to the US Government or FHA. You also may have to pay additional fees and payments as part of your monthly bills afterward.

Conventional Loans

People who put down less than the traditional 20 percent on a conventional loan will often have to pay mortgage insurance as a stipulation of getting the loan. These insurance policies come from private companies, usually called PMI—or Private Mortgage Insurance.

How much you expect to pay will depend on the company you and your lender choose to insure your loan, and it also can change based on your down payment. You can discuss this with your lender to determine how much PMI you must pay.

VA Loans

VA loans offer much more leeway than a typical loan, but veterans must know they may still owe mortgage insurance.

It’s all dependent on the type of service you did, the financials of your loan, and whether you’re refinancing. Sometimes, even having your first VA loan can trigger this need.

VA loan insurance is not PMI. Instead, it’s set up the same way as USDA and FHA loan insurance, and it’s all government-sponsored.

How Does PMI Work?

Once agreed upon, the bank arranges PMI via its insurance providers. They notify you of how many PMI payments you will owe and for how long, and the borrower makes those payments monthly in addition to the mortgage.

Is PMI Tax-Deductible?

Can I deduct private mortgage insurance on my tax return? Yes, those payments are tax-deductible under the Further Consolidated Appropriations Act, 2020. However, borrowers can only take the PMI deduction if they itemize their deductions.

You might be losing money if your total itemized deductions are less than the standard deduction amount.

When Can You Stop Paying PMI?

You can request to remove PMI in writing. Banks will cancel them if you have met the following criteria:

- The loan balance became less than 80% of the loan’s balance (or 80% of the home’s current value).

- You made consistent and timely payments, and your loan is current with payments.

- You do not have any second mortgages.

An appraisal is sometimes helpful to prove that the home’s value has not decreased below the original cost.

When are mortgage lenders required to cancel?

Banks must cancel PMI once you meet the following criteria:

- The loan amount has reached 78% of its original value.

- The borrower has a good track record with payments, and

- The loan is not high-risk.

How Much Does Mortgage Insurance Cost?

Mortgage insurance rates (and PMI) can vary depending on who’s funding it and what kind of risk you potentially pose to a lender. A good rule of thumb is that your mortgage insurance will cost between 0.5 to 1.85 percent of the home’s purchase price of your home every year. So, if you have a $100,000 home, that will come to around $500 a year.

This amounts to $30 to $70 monthly for every $100,000 you paid for your home. If you have a half-million-dollar home, you should expect to pay around $150 per month.

Does Mortgage Insurance Last For The Duration Of The Loan?

In most cases, mortgage insurance will last for the entirety of the loan. So, this is a fee you better get used to paying. However, in some cases, you may be able to cancel out PMI later on down the road. You must reach 80 percent LTV to waive PMI most of the time.

Is Paying PMI Worth It?

Paying mortgage insurance is not ideal, but it could be worth it for many people.

This can often be a barrier breaker for people who would otherwise lose out on building equity.

Since rents are skyrocketing across the nation, now is the time to get a more stable form of housing, and buying a home can do that.

Calculate Your PMI (Private Mortgage Insurance on Mortgage)

The PMI depends on the LTV (“Loan to Value”). Once you have this LTV, you can look at your bank’s PMI chart to see the percentage of PMI you will pay. Then, you would multiply your loan amount still owed to the bank to find your annual PMI rate.

For example, if you have to pay 0.75% PMI, you multiply by the mortgage amount (say $500,000), and you get $3,700 per year or 312$ monthly.

How to Avoid PMI (Private Mortgage Insurance on Mortgage)?

You don’t want more money added to your already expensive mortgage.

- Save money towards that 20% down payment. Therefore, you avoid PMI and decrease your interest mortgage rate.

- Pay a higher mortgage interest rate. Smaller down payments mean a higher interest rate (instead of a PMI).

- Get an 80-10-10 loan, aka a piggyback loan. This structure allows you to buy a property with two mortgages totaling 90% of the purchase price. The first loan covers 80%, while the other loan finances the 10% down payment.

- Apply for a VA loan. A Veterans Affairs loan requires mortgage insurance, and FHA mortgage loans do not charge PMI but have their own types of mortgage premiums.

- Apply to FHA loans. With those loans, mortgage insurance becomes required through the government rather than private. You can remove MIP or Mortgage Insurance Premium from an FHA loan after 11 years, provided you have initially put more than a 10% down. You cannot use FHA loans to purchase co-ops, and very few condos allow you to go through the vetting process required for FHA approval.

- Refinance the loan. If your new mortgage’s LTV is lower than 80%, you can eliminate PMI and lower the interest on the loan due to refinancing.

What is the difference between MIP and PMI?

The federal government manages MIP, and it comes with restrictions. For example, the FHA has maximum loan limits lower than those with PMI. FHA insurance remains for the total duration of the loan, and you cannot remove PMI from a loan.

Pros and Cons of PMI (Private Mortgage Insurance on Mortgage)

Weigh all options before deciding!

Pros

- Buy a property with a lower down payment.

- You get more for your money. if you need more money for furniture or fix-ups

- PMI remains temporary. You can cancel your PMI after some time.

Cons

- PMI is an additional monthly cost. Indeed, it usually costs 0.5%- 1% of the total annual loan amount (on top of your mortgage and fees).

- PMI only protects the bank, which does not cover the purchaser, only the bank.

- It is sometimes challenging to cancel. You can cancel PMI after you pay off 20%. However, you must send a written cancellation notice with an official appraisal before removing the PMI.

The 4 Different Types of PMI (Private Mortgage Insurance on Mortgage)

- Borrower-paid PMI (BPMI). The most basic of PMIs. The PMI gets added to your mortgage, and you can cancel it. BPMIs represent a fixed rate throughout your loan.

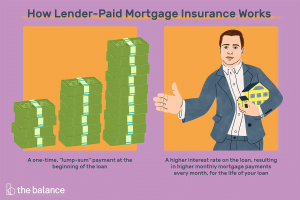

- Lender-paid PMI (LPMI): Your lender will front the cash for your mortgage insurance at a higher rate. You cannot cancel this type of insurance.

- Single premium PMI (SPMI). In this case, there are no monthly payments, as you pay the premium upfront. Of course, it is non-refundable.

- Split premium PMI. It is a combination of BPMI and SPMI. In other words, you pay part of the coverage in a lump sum at closing and the rest monthly.

What is the Best Type of PMI (Private Mortgage Insurance on Mortgage)?

It remains the one that works best for your situation, goals, and budget. For example, if you don’t plan on moving or refinancing, you might want to explore buying out their mortgage insurance with LPMI or a borrower-paid single monthly premium.

Meanwhile, if your future is less predictable, you may prefer the basic borrower-paid PMI as it provides the lowest risk.