2022 Guide Reverse Mortgage in New York City

Go Back To Previous PageA reverse mortgage may be just right for you if you need money to live comfortably after retirement or are approaching retirement. How does a reverse mortgage work? Where to find a reverse mortgage calculator? This instrument can be the solution to many debt problems and financial issues. However, you borrow against the equity you’ve built in your home. Therefore, there are many requirements you need to know before signing on the dotted line. Borrowers may want a more comfortable retirement. There are many pros and cons to reverse mortgages.

can be the solution to many debt problems and financial issues. However, you borrow against the equity you’ve built in your home. Therefore, there are many requirements you need to know before signing on the dotted line. Borrowers may want a more comfortable retirement. There are many pros and cons to reverse mortgages.

They may need the cash to buy a second home, a pied-à-terre, or make home improvements. While a reverse mortgage has many benefits, you must decide if it’s the best option. You must understand a reverse mortgage and know if it’s right for you. We’ll cover everything so you can make an informed decision.

What is a Reverse Mortgage?

A reverse mortgage allows older people (62 and up) to borrow against the equity in their primary residence. A home equity loan lets you maintain ownership while converting your home’s equity into cash.

maintain ownership while converting your home’s equity into cash.

In many states, particularly New York City, a reverse mortgage loan allows you to access tax-free funds by taking a portion of your equity, eliminating monthly mortgage payments on your primary home.

Why Would Older People Take Out a Reverse Mortgage Loan?

There are risks involved in a reverse mortgage, but borrowing equity from your home can provide you with funds. This is if you have money in your home but not enough in your bank. Other reasons include not having enough money to cover retirement expenses or needing a way to supplement your income.

You may be on a fixed income, barely covering ordinary expenses and monthly obligations like home insurance. Or the money allows you and your spouse to live comfortably during retirement.

If older people have insufficient funds, a reverse mortgage may be the best way to get money to avoid turning to high-interest lines of credit or other more costly loans. But, depending on your loan type, the money is yours, and you can use it for any reason. You can use it to renovate your home, afford proper health care, give portions to your children or heirs, or pay off debt.

How Does a Reverse Mortgage Work?

A reverse mortgage is a great way for retirees to benefit from the home mortgage loans they have been paying throughout their lives. Finally, they can capitalize on their home’s value. If a reverse mortgage loan is approved, all that hard work will be saved, and the loan will be paid.

can capitalize on their home’s value. If a reverse mortgage loan is approved, all that hard work will be saved, and the loan will be paid.

A reverse mortgage allows people 62 and older to borrow from their home’s equity without making monthly loan payments. You don’t have to make monthly principal and interest payments on the reverse mortgage, which frees you from paying monthly mortgage expenses. So, a reverse mortgage is the opposite of a traditional or home mortgage loan.

With a conventional mortgage, you make monthly payments to a lender; with a reverse mortgage, the lender makes payments to you.

As long as you continue living in your primary residence, you don’t have to pay the portion of the equity you borrow. While you have the reverse mortgage loan, remember that you don’t have to sell your home to your bank or move out of the house.

As indicated above, you don’t have to make monthly payments on the loan. Since a reverse mortgage is essentially a loan, you retain home ownership. And your loan lender won’t touch your title or alter your ownership rights to sell your apartment.

If you want to repay the loan, you won’t be penalized, although many older people don’t do this because they need all the money they can get. A reverse mortgage provides a line of credit and a steady, reliable monthly income.

When Do You Pay a Reverse Mortgage Back?

You don’t have to make monthly payments until the reverse mortgage loan reaches maturity. You can defer payment until you pass away, sell your home, or if you are the final home borrower and you move out of your home permanently, such as going to a nursing home.

The loan also comes due if the borrower fails to pay maintenance charges, insurance, or taxes, or to maintain the home’s integrity.

How Much Can A Homeowner Borrow?

People over 62 may not be able to borrow their entire equity even if their home mortgage is paid off. That’s because the amount of money you can borrow, known as the principal limit, varies based on the youngest borrower’s age, current interest rates, and your home’s appraised value.

borrow, known as the principal limit, varies based on the youngest borrower’s age, current interest rates, and your home’s appraised value.

The principal limit will be higher if people are older and their property is worth a lot. Also, the funds may increase if the homeowner has a variable-rate HECM.

HECM stands for Home Equity Conversion Mortgage (HECM). As we’ll discuss in more detail later, the Federal Housing Administration (FHA) offers the HECM, the most popular type of reverse mortgage loan.

You will receive a lump-sum payment if a HECM has a fixed interest rate. With a variable-rate HECM, you have more options. You can be paid equal monthly payments for a fixed period of months. You can draw a line of credit until it runs out, a combination of the two, and more.

What are the Eligibility Requirements for a Reverse Mortgage?

To qualify for a reverse mortgage, you must meet many requirements.

a) You Are Close to Paying Off Your Home Mortgage

It’s preferable to the lender that you own your home outright, have a low mortgage balance, or have at least 50% equity in your home. That way, your interest rates will be lower and on favorable terms. But even if you don’t reach those scenarios, you can still qualify for a reverse mortgage.

That way, your interest rates will be lower and on favorable terms. But even if you don’t reach those scenarios, you can still qualify for a reverse mortgage.

b) How much can you get from a reverse mortgage?

When you take out a reverse mortgage loan, you must follow the overriding guide to pay off your existing home mortgage. If you are not even close to paying it off, don’t worry. You can use the money from your reverse mortgage to pay off your lender.

That’s why it can be vital that you are close to paying down your home loan. If you aren’t, the money you receive after subtracting the fee for paying off your home mortgage will be lower than you may be counting on.

If there’s a balance on an existing home equity loan or any tax liens or judgments, these also must be paid by the reverse mortgage, making your allocated funds even lower.

You’ll get even lower if the following is true. You must also pay these off if you have a lot of debt and high collection fees. If you can’t afford to pay the debt, you can get a cash advance from the reverse mortgage to close your high-debt accounts. Examples include credit card debt or ambulance and hospital fees that your insurance doesn’t cover.

Lastly, it would help if you accounted for home improvements you must pay for to qualify for a reverse mortgage. This will be another hit to you, reducing the funds you’ll receive.

After you take care of your finances, the reverse mortgage lender will only pay you the remaining balance. Older people typically receive around 50% of their home’s appraised value. If you are lucky enough to own your home entirely, you’ll receive all the funds from the reverse mortgage loan since you don’t have a mortgage balance to pay off first.

c) You Must Remain Current on Home Dues

These include keeping current on property taxes, homeowner’s insurance, and homeowners’ association fees. Since the interest on a reverse mortgage accumulates monthly, you’ll still need enough income to pay these dues.

reverse mortgage accumulates monthly, you’ll still need enough income to pay these dues.

d) Primary Residence

Your primary residence must be your home, and you qualify for the loan if you have lived there for more than 6 months. While residing at your primary residence to get the loan seems obvious, this housing must be where you borrow equity.

e) You Must Maintain Your Primary Residence

A primary residence must be maintained and be in good working order to meet the Federal Housing Administration’s (FHA) strict standards. If your plumbing is awry in New York, you must pay for that. If the neighbor above you has a leak that creates water stains on your ceiling, you must fix the leak and paint the ceiling.

f) You Must Receive Reverse Mortgage Counseling

A HUD-approved reverse mortgage counselor must interview borrowers. Many think they can get away from counseling. Still, the interview is essential because the counselor determines your ability to pay by factoring in your income and debt obligations.

If you don’t seek and complete counseling, you will not receive a signed, delivered certificate of completion to the lender you plan to use. More onerous is that your lender will not disburse the funds if you don’t undergo counseling.

What Are the Types of Reverse Mortgages?

There are three types of reverse mortgages, each suited to a different financial need.

1) Home Equity Conversion Mortgage (HECM)

A HECM is only offered by and insured by the Federal Housing Administration (FHA)-approved lenders. This is the most popular and widely used type of reverse mortgage, often chosen by borrowers. With HECM, borrowers receive tax-free funds from their lenders, and heirs inherit any remaining equity after the borrower pays the reverse mortgage in full.

2) Proprietary Reverse Mortgage

A PRM is a private loan not backed by the government but instead supported by private lenders, and there are no restrictions on how you can use the equity. Unlike HECMs, PRMs provide more significant loan amounts, especially if you have a high-value home. However, like HECMs, proprietary reverse mortgages only allow older people to borrow a fraction of their home equity, often 50%.

Unlike HECMs, PRMs provide more significant loan amounts, especially if you have a high-value home. However, like HECMs, proprietary reverse mortgages only allow older people to borrow a fraction of their home equity, often 50%.

3) Single-Purpose Reverse Mortgage

This loan is used less often than the other two and is offered by nonprofit organizations and state and local government agencies. The reason is that the borrower can use the funds only for a specific purpose. An example is replacing steps in a home with accessibility or wheelchair ramps.

How Much Does a Reverse Mortgage Cost?

There are several fees involved when getting a reverse mortgage. Closing costs are the most expensive, but if you have a HECM mortgage, you can roll them into the equity loan, saving you from having to shell out the money up front. The following are the other fees you should come to expect.

1) Mortgage Insurance Premiums (MIP)

Your loan lender charges an initial and annual mortgage insurance premium, and this is not homeowners’ insurance but an additional premium. The MIP guarantees you will receive the loan advance as you decide how to disburse funds. There is 2% of the home’s appraised value at closing, and an annual MIP accrues annually when the loan comes due. This charge is 0.5% of the outstanding loan balance, and the borrower can finance the MIP into the loan.

When you close a loan, the borrower pays the upfront MIP to the FHA. It turns the loan into a non-recourse loan to protect you and the lender. A non-recourse loan means that you and your heirs are not personally liable for any portion of the mortgage that exceeds the value of your home.

This happens when the loan reaches maturity, or the borrower repays it. So, if you sell your house for less than what is due on the loan, the MIP swoops in and pays for the difference so that you don’t default and the lender doesn’t lose money. This is a significant investment for the lender.

2) Origination Fee

A mortgage origination fee is the money a lender charges to originate and process the loan. The lender will charge more than $2,500 or 2% of the first $200,000 of your home’s value, plus 1% if the home’s value exceeds $200,000. The FHA sets the origination fee, which cannot exceed $6,000 and is paid directly to the lender. The law establishes a cap to keep closing costs reasonable for borrowers.

3) Servicing Fees

A lender will charge you a monthly servicing fee to maintain and monitor your loan for its duration. The cost can’t exceed $30 for a loan with a fixed rate or an annually adjustable interest rate, or $35 for a loan with a monthly variable rate.

4) Appraisal Fees

You must hire and pay for an appraisal to determine the borrower’s home’s value. The cost depends on the home’s size and location. The appraisal fee can cost only around $300, but it usually skyrockets, and you may have to pay as much as $500. Be prepared to allocate funds just for the appraisal.

5) Other Fees

If you’ve ever purchased a home with a mortgage, you should be familiar with the fees below that you must pay at closing.

- Closing report fees are $30-$50

- Document preparation fees are $50-$100

- Courier fees are $50

- Title search/title insurance varies depending on the loan and the location.

- Closing fee

This is one of the most expensive upfront fees. It can start at $150 (but never does) and go as high as $800 or more.

What Dwellings in New York City Qualify for a Reverse Mortgage?

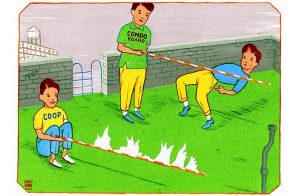

A stipulation that New York homeowners don’t need to consider is that they can’t live in a mobile home or a manufactured home. The only housing type in New York City that allows for a reverse mortgage is a condo, but it must be on the HUD/FHA-approved condo list. You may still be eligible for a proprietary reverse mortgage if it’s not.

HUD is the Department of Housing and Urban Development, which works with housing agencies to manage low-income homes. A reverse mortgage is not an option for those who live in co-ops, and banks don’t allow reverse mortgages because, unlike a condo, a co-op is not real, tangible property.

In a co-op, you buy shares in a corporation. This is one reason reverse mortgages are unpopular in New York City.

Can You Be Denied a Reverse Mortgage?

Not usually. A lender will check a borrower’s ability to repay current and future financial obligations, which is a bit laxer than qualifying for a home mortgage loan.

For example, there are no income requirements, so those on fixed incomes won’t have to worry about being rejected. What counts are the stipulations? As we covered, these include living in the home for most of a year, having enough equity in your home to qualify for a loan, and being over 62. If you meet these stipulations and others, you will most likely be able to borrow equity from your home to get the loan.

But if you have been late in paying your mortgage or paying off the high debt within the past 24 months, there’s a big chance that you may not qualify.

Could a Reverse Mortgage Affect Heirs?

Do you want your family to keep your home if you die? Or do your heirs wish to keep the house? If so, your family must repay the loan with their own money. eIf they lack the funds, they can take out a mortgage or refinance their home, but only if they qualify.

If they can’t cover what is due, they may not keep the house in the family.

They may leave the property if they think the home’s accrued interest is too high.

The reverse mortgage lender will have to foreclose on the home in that situation. There is a solution if close family members or other heirs sell the house to pay the reverse mortgage. If they fail to do any of the above, then a reverse mortgage is only a good idea if you don’t plan on passing down your home to your heirs.

Can a Spouse Continue to Live in the Home if You Die?

Yes. It should be taken care of if you are married, as you and your spouse are the co-borrowers on the reverse mortgage loan. If you don’t pass but have to move out of the house to go to a nursing home, your spouse can remain in the place and even continue to receive funds derived from your equity.

Even if your spouse is not a co-borrower, the spouse can live in the home if you pass due to a law stipulated by HUD. This is called the Eligible Non-Borrowing Spouse.

Do Your Due Diligence When Applying for a Reverse Mortgage Loan

It would help if you looked at many reverse mortgage lenders to get the best deal. That means you should look for a lender with the lowest interest rates and upfront and recurring fees. Call around to find the cheapest lenders, but get answers to your basic questions. Some questions are as follows:

- What loan options do you have?

- How much do I qualify?

- What fees do you charge?

- How are funds allocated, and when?

- Are there any restrictions on the funds if I qualify for a reverse mortgage loan?

- What are the upfront costs?

Note that some lenders may look good on paper because of their low interest rates. But they charge more up front or make you pay unnecessary fees. So do your homework.

unnecessary fees. So do your homework.

Why a Reverse Mortgage Might Not Work

Reverse mortgage loans are made for those above 62 who have decided to remain in their homes for the rest of their lives. A reverse mortgage loan may be wise, as it offers a reasonable term and lets you borrow from your equity to stay stable or live comfortably.

However, we do not recommend a reverse mortgage if you plan to move soon or within a few years due to medical issues, such as receiving care in a nursing home.

What are the Disadvantages of a Reverse Mortgage?

There are many disadvantages of a reverse mortgage, and the most important ones are as follows:

- Getting the loan will increase your debt and decrease the funds you’ll get from your lender.

- You don’t need to pay your loan during your lifetime, but your loan balance will increase as interest accumulates.

- You may want to make your house available to your heirs after you die, but maybe the only way they can keep the house in the family is to cover the remaining loan balance.

- If you fail to pay your financial obligations or maintain your home to keep it in good shape, your loan can come due.

- Borrowing may disqualify you from receiving government benefits such as Medicaid or SSI (Supplemental Security Income). NB: A reverse mortgage will never affect your Social Security Benefits or Medicare.

- You can’t deduct the interest you’ve paid on your annual tax return until the loan is paid off entirely.

- The interest rate on your loan starts immediately after you close. Your interest will accumulate until you pay off the loan and, depending on the lender, accrue monthly or annually.

In conclusion, Research reverse mortgages and become as well-informed as possible. The more you know, the more confident you will be in your decision. There are risks; the more information you have, the easier it is to determine whether the benefits outweigh the risks. Depending on your situation, there may be better options for you.

A financial planner or a loan officer can discuss various options with you. An example is selling a home and purchasing a smaller property.