Is It a Good Idea to Refinance Your Mortgage? – 2023

Go Back To Previous Page Since the pandemic, mortgage rates have hit a record low. In 2020, a 30-year fixed mortgage rate was 3.86%, and now it has fallen to 2.96%, according to Bankrate. Many homeowners seek solutions for multiple debts and often turn to refinancing as a strategic approach to consolidate them, lowering their overall monthly payments. The most common reason for refinancing your home is to receive a better interest term and rate. Other homeowners refinance to remove a sum from their equity and replace their monthly mortgage payment with a longer repayment term. Lower interest rates mean saving money and paying down your principal faster.

Since the pandemic, mortgage rates have hit a record low. In 2020, a 30-year fixed mortgage rate was 3.86%, and now it has fallen to 2.96%, according to Bankrate. Many homeowners seek solutions for multiple debts and often turn to refinancing as a strategic approach to consolidate them, lowering their overall monthly payments. The most common reason for refinancing your home is to receive a better interest term and rate. Other homeowners refinance to remove a sum from their equity and replace their monthly mortgage payment with a longer repayment term. Lower interest rates mean saving money and paying down your principal faster.

Paying down your principal makes you carry less debt and gives you more equity or buying power. Refinancing your home loan is probably the right path to reduce overall expenses. But there are drawbacks when you refinance.

They include paying high-cost closing fees and costing you more in the long run when you refinance to lower payments over a more extended period. Also, a mortgage origination fee and the financial institutions charge any other upfront fees before getting approved for a loan.

It would help if you always were sure you were in the proper financial position to take out a new loan: a high credit score, a steady job, and enough liquidity to pay your new mortgage. So, while lower interest rates and smaller monthly mortgage payments may be what you’re after, there are always risks when refinancing.

1. What is Refinancing your mortgage?

Refinancing a mortgage is when you take out a new loan to repay your original mortgage. Therefore, the latest loan then replaces the existing one. The interest rate determines when you should refinance, and you should consider refinancing if the interest rate is lower than your current rate.

interest rate determines when you should refinance, and you should consider refinancing if the interest rate is lower than your current rate.

The most recommended option is to refinance your existing mortgage to a 15-year fixed-rate one. The premise of refinancing your mortgage loan is the same as when you took out a loan to buy your home. Once again, you must pay fees, taxes, and closing costs. And there is more than that, which we’ll discuss.

When you refinance, your mortgage lender will determine your home’s current market value and look at your financials. These include your credit and tax return history and verifying your credit. If the lender feels you have enough finances to keep paying your new mortgage and property taxes, the lender will help you by offering you an interest rate lower than your existing one.

The lender will also give you options to lower your monthly mortgage payment, borrow equity from your home, and reduce the years on your loan.

2. Do Your Due Diligence before you Refinance Your Mortgage

It would be best if you researched to find a lender that has favorable terms. You should compare and contrast your loan options with different lenders. Remember, you have a choice and don’t have to refinance with your current lender.

You should apply to as many mortgage lenders as you can. However, it would help to consider how often your credit gets pulled when applying to multiple lenders.

The best way to find a reputable lender is by working with a mortgage broker who can recommend several lenders that best meet your needs. Once you apply for preapproval with a lender, the lender will give you a loan estimate that lays out your refinancing costs.

3. How Long Does It Take to Refinance your mortgage?

Refinancing your home is like the process you went through with getting your original mortgage loan. You need to fill out the loan application, and you need to submit documentation. For example, these include pay stubs or copies of your bank statement.

If interest rates are low and the lender deals with many new applicants who want to take advantage of those rates, the lender may take longer to process your loan.

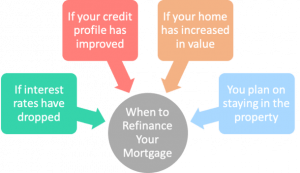

4. Why You Should Refinance Your Mortgage

There are several reasons why homeowners consider refinancing their mortgages. Most people refinance when they have equity in their home, which is the difference between the amount owed to the mortgage company and the home’s worth. If your cost of living increases, because you have a baby or your income has decreased because you took a better job with less pay or were laid off, refinancing may benefit you.

In a nutshell, here are the reasons why you should refinance.

- Get a lower interest rate (APR).

- Structure a lower monthly payment.

- Reduce payoff term.

- Cash out your equity to pay off debts, remodel your home, or pay for your child’s education.

Lower Your Interest Rate

The number one reason many refinance is to get a lower interest rate on their mortgage. You could save money through refinancing if your current interest rate is higher than today. It’s often said that if mortgage rates are lower than your current rate by 2% or more, it’s an excellent time to refinance.

today. It’s often said that if mortgage rates are lower than your current rate by 2% or more, it’s an excellent time to refinance.

But even at 1%, that’s also a reason to refinance. When you reduce your interest rate, it helps you save money. Say your mortgage is $250,000 with a 6% interest rate.

If you can lower that rate to 3%, you save $400 monthly on interest and principal payments, giving you extra cash for your financial goals or savings. A lower rate means lower monthly payments, and not only that; you’ll pay less for your house overall.

Remove Your PMI

With a lower interest rate on your refinancing, it’s possible to have your PMI removed. The PMI costs $300 to $400 monthly on top of your principal and interest. If you eliminate the PMI, you save that money each month. This will work if your new mortgage is for 80% or less of the home’s current appraised value.

PMI (Private Mortgage Insurance) protects the lender, not you, from defaulting on the loan. It is used when a borrower buys a home with a small down payment of less than 20% and trim down costs for lenders pose a risk.

Even if a homeowner has built up a high amount of equity, if you have used FHA or USDA loans, which are Federal government-backed loans, they may still require the homeowner to pay the PMI in the ongoing years to come. But if the homeowner has 20% or more equity, a conventional loan will no longer require the PMI. Thus, a traditional loan is better than a government loan.

Homeowners with a government loan often go out of their way to increase their creditworthiness and score to move to a conventional loan to avoid paying the monthly mortgage insurance.

Shorten Your Mortgage Length

If you don’t want to make monthly mortgage payments in the coming years, you can refinance to shorten your mortgage length. If you convert from a 30-year mortgage to a 15-year mortgage—the recommended option to refinance, as we said earlier—you can pay off your loan faster or earlier.

convert from a 30-year mortgage to a 15-year mortgage—the recommended option to refinance, as we said earlier—you can pay off your loan faster or earlier.

You save a lot of money in interest payments over the life of your loan and build equity in your home faster.

In the process, you will increase your monthly payment since your lender will require more significant amounts to pay off your balance in a shorter period.

Also, if you have an existing 30-year mortgage on your house and refinance with another 30-year term to reduce your monthly mortgage loan, it will take you longer to pay off your home, and you will end up paying more interest over the life of the mortgage loan. The length of your mortgage depends on your goals.

A shorter-term loan is ideal since some mortgage holders want to pay their loan sooner or less in lifetime interest. But a long-term loan is usually best to lower your monthly loan.

Borrow from Your Home Equity

If you have over 20% equity in your house, you can use cash-out refinancing to borrow against your equity. A cash–out mortgage refinance is when you borrow equity and get cash in exchange for taking on a larger mortgage. Essentially, you borrow more than you owe on your mortgage and pocket the difference.

Borrowing against your equity has several advantages. It gives you money to pay off credit card debt and student loans, pay for school tuition or medical costs not covered by your health insurance, buy a new car, and even go on a much-deserved vacation.

Homeowners cash out mainly to use the money to remodel their homes or make improvements. It’s done not just to update the house or give you more space but also to help you increase your home’s value.

Debt Consolidation

Many homeowners use refinancing to consolidate debt to lower their overall monthly payments.

Another alternative to a mortgage is a promissory note.

- A promissory note is a document between the lender and the borrower in which the borrower promises to repay the lender. It is a separate contract from the mortgage.

- The mortgage is a legal document that ties or “secures” a piece of real estate to an obligation to repay the money.

As a lender, you can sell your promissory note to another lender or sell the mortgage.

Changing Your Rate Type

Suppose you have a mortgage with a riskier loan, such as an adjustable-rate mortgage (ARM). You can refinance and use a new loan with a fixed-rate mortgage. A fixed-rate loan may end up being higher. However, when loan rates increase, you’ll be secured.

Essentially, moving to a loan with a fixed- rate can protect you from market fluctuations.

Also, you’ll know your monthly mortgage loan and have the same principal and interest payment every month. This will help you allocate funds for the future, so you’re never short on paying these fees. It will set you on a path to a reasonable budget, so you’re never caught off guard when there are financial surprises.

So, it’s good to get out of an adjustable-rate mortgage. However, if rates drop, you won’t be able to take advantage of that without another refinance.

5. What is the Break-Even Point when you Refinance Your Mortgage?

You need to figure out how long it will take for monthly savings to recoup your refinancing costs. Factors in your closing costs: On average, they are 2 to 5% of the loan amount and any fees related to the refinancing. To see if you’re saving enough, calculate your “break-even point,” which is how long your savings from a lower mortgage rate will take to exceed your closing costs.

the loan amount and any fees related to the refinancing. To see if you’re saving enough, calculate your “break-even point,” which is how long your savings from a lower mortgage rate will take to exceed your closing costs.

So, if your closing costs cost $4,000, including lender, title, and third-party fees, and you save around $200 a month, your break-even point would be 20 months. You will save money every month after that. You can use a refinance break-even calculator to determine how long this would be.

6. The Cons of Refinancing your mortgage

Closing Costs When You Refinance Your Mortgage

If you refinance, you have to consider it takes a lot of money. Once again, you must pay upfront fees and fees to the banks and credit unions to initiate a loan and closing costs. Closing costs include application fees, lawyer fees, loan origination fees, underwriting fees, taxes, mortgage insurance, and other closing fees.

closing costs. Closing costs include application fees, lawyer fees, loan origination fees, underwriting fees, taxes, mortgage insurance, and other closing fees.

Because most homes’ costs and value have declined over the past decade, you must also pay for a new appraisal. Without an assessment, your refinancing lender may be unwilling to give you a loan for more than your house is worth.

Also, you need to pay the fees below:

-

- Application Fees $75-$100

- Appraisal $300-$700

- Survey Cost $150-$400

- Title costs $700-$900

- Home inspection $175-$350

The high fees for the closing cost can make you think twice about refinancing. But note that the bright side is that you can roll in these costs with your new loan. The mortgage lender Freddie Mac suggests you spend around $5,000 during closing. But that’s a lowball figure.

Most homebuyers pay over $10,000 and up to $15,000 because Freddie Mac doesn’t include home inspections and application fees when coming up with a round-about closing cost figure.

Your Credit Score Will Take a Hit

When you check rates with a lender, the lender will run your credit report. As we mentioned, you should always look at multiple lenders to get the best interest rate, but the downside is that your credit score will be affected. This happens because your credit pull is a hard inquiry, so your credit score will dip by a few points.

However, you can avoid multiple hard inquiries using smart rate shopping and getting all your applications in during a 14- to 45-day period. While it depends on the type of loan you receive, this reprieve may only count as one inquiry when your score gets calculated during that period.

A Longer Break-Even Point

One of the reasons to avoid refinancing is it takes too long for you to get back the closing costs on a new loan. This is your break-even point; once again, it’s the number of months it takes to reach the moment you start saving. When you lengthen the life of your loan by many years, your break-even point will be cast further out in the distant future, making it longer for you to get back your closing costs on your new refinancing loan.

Adding Time to Your Loan

When you refinance to lower payments over a more extended period, you are lengthening the time it takes to pay off your loan. It may cost you more in the long term because interest is compounding, despite the fact you are reducing your loan rate.

Cash-out Refinance

Cashing out your home equity gives you more cash to make home improvements or buy significant purchases like a new car. But you’ll reduce your home equity and increase your new loan balance. And because you are resetting your loan term, you’ll pay more in total interest.

You May Be Subject to a Penalty

Some mortgages have prepayment penalties if you reduce your balance earlier than your loan term. To avoid this situation, you need to know all the terms and conditions of your new loan before closing.

7. How Do You Qualify for a New Mortgage?

If you found your ideal lender, your closing costs and attendant fees may vary. The median rate is roughly 2-5 % of the loan amount but often can be more than that.

more than that.

Here’s what you need to qualify for the new loan. Like with your original mortgage, your potential lender will consider the following.

8. Can I Be Denied a Refinancing Loan?

There are many reasons a lender won’t allow you to refinance your mortgage. The most popular reasons are as follows.

Unsteady Job History

It would help if you had a steady job. A stable job with a lender means you have a steady income. You should have at least two years of employment in the same position. If there are gaps in your job history, or if you keep switching jobs, a lender may deny you a new loan.

However, a lender may give you a new loan if you have a new job. But only if it’s the same profession as your former job.

Lack of Funds

The lender will require enough cash and little debt while paying your new loan. If you don’t have enough liquidity or backup money in your savings, the lender will deny you again. The lender will want to see your bank statements for the last two months to prove you have sufficient income to pay your new mortgage. It depends on the lender.

will want to see your bank statements for the last two months to prove you have sufficient income to pay your new mortgage. It depends on the lender.

Higher Debt-to-Income Ratio

Having more debt than cash is a no-no, and the debt-to-income ratio is one of the most critical factors that the lender will look at.

Your Credit Score Dropped

If your credit score takes a hit, you might not qualify for the refinance loan. The underwriter will want to see a credit score above 700; if it drops to 650, this might hinder you.

9. How to Determine if Refinancing your mortgage Makes Financial Sense For You

Use one online mortgage refinance calculator to determine if refinancing makes financial sense. To see if you will have potential savings, you’ll need to factor in all the costs related to refinancing your loans, such as the dreaded closing cost and more. If you have less than 20% equity, the lender will require you to have mortgage insurance if you default on the loan.

So be sure to add mortgage insurance, which is expensive, to your costs. Once you determine your new loan’s interest rate, you can calculate your new monthly mortgage loan payment to see how much you will save each month. Refinancing right now is not a good idea if you don’t have savings.