Title Insurance NYC – Guide for Buyers in 2023

Go Back To Previous PageOrdering a title search and purchasing title insurance is integral to buying a condo, co-op, or townhouse in New York City. These can protect you from potential problems you may be responsible for if left unresolved. Read on to learn why getting title insurance is necessary and how it can help you. How much is title insurance in NYC, and who pays for title insurance in New York? Whether you are researching the potential closing costs you will pay or are simply learning terms mentioned by your real estate attorney, title insurance is one of the fees you are likely to encounter. We will reveal the cost of title insurance in New York State.

protect you from potential problems you may be responsible for if left unresolved. Read on to learn why getting title insurance is necessary and how it can help you. How much is title insurance in NYC, and who pays for title insurance in New York? Whether you are researching the potential closing costs you will pay or are simply learning terms mentioned by your real estate attorney, title insurance is one of the fees you are likely to encounter. We will reveal the cost of title insurance in New York State.

What is a Scenario That Can Protect You if You Undergo a Title Search and Purchase Title Insurance?

Let’s assume you just bought your condo in New York City. But suppose after you close, you find out that the prior owner of your condo died and left behind several liens against your property because of failure to pay taxes and HOA fees.

behind several liens against your property because of failure to pay taxes and HOA fees.

What happens, then?

Well, you probably have to pay the outstanding costs. Therefore, the mortgage lender could care less that you didn’t cause the liens and may go after you to pay the unpaid debt attached to the apartment. And the lender is legally within their rights to do so.

Can This Be Avoided?

Every prospective homebuyer needs to conduct a licensed title search during the house’s closing to ensure no defects can negatively affect them down the road.

But a title company can’t always catch all the defects. It would help if you had title insurance to protect you from inconsistencies before your ownership.

Definition of a Title?

A title (a.k.a. a real estate title) is a series of reports and documentation that shows that you own or have the right to own your condo, co-op, or townhouse in New York City.

condo, co-op, or townhouse in New York City.

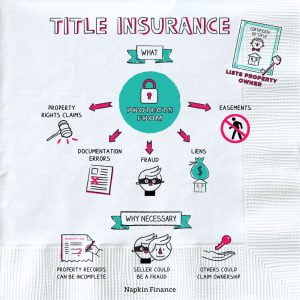

What is Title Insurance, and Do You Need It in New York City?

Title insurance is a type of indemnity insurance common in the United States. The primary purpose is to protect against financial loss from any defects in the title of real property that may result in the loss of ownership by future claims.

Therefore, lenders require title insurance if a buyer purchases the real property with financing from a mortgage lender.

Errors, defaults, and defects

Title insurance protects a homeowner against errors, defaults, and defects that may have happened before they owned the apartment or because your title search failed to identify them when you purchased the home.

These include unpaid property taxes, liens, forged title documentation, and unpaid debt caused by the previous owner of your apartment. Title insurance also protects your rights as an owner after closing your property purchase.

Let’s say somewhere down the line, after you have purchased your home, you discover that the seller had bequeathed your property to their grandchildren in a newly discovered will.

Do You Need Title Insurance For a Condo or a Townhouse in New York City?

No. The owner’s title insurance isn’t required, but we highly recommend getting it to protect a homeowner’s interests. Nevertheless, you can’t sidestep it. It’s a closing requirement for NYC buyers who purchase a home in New York City with a mortgage.

Nevertheless, you can’t sidestep it. It’s a closing requirement for NYC buyers who purchase a home in New York City with a mortgage.

If you purchase a property with a mortgage, the mortgage lender will require you to get title insurance and a title search.

Why?

In short, it protects the lender. Typically, you can’t close without title insurance, which is one of the highest closing costs for homebuyers in New York City.

If you buy a home all cash, it’s up to you whether or not you should get it. But even then, you shouldn’t risk it. A missing heir may suddenly appear after you buy the property.

For example, unpaid property taxes by the previous owner or liens against a property are two potential issues that title insurance protects you (and your bank) against. While not an insignificant cost, a mortgage company probably won’t lend you money without it.

Do You Need Title Insurance For a Co-Op in New York City?

If you buy a co-op in the city, you won’t be required to purchase title insurance. That’s because a co-op apartment is not real property. You purchase shares of a corporation that owns the entire apartment building, and these shares provide you with a proprietary lease.

As such, you don’t have absolute property rights. Therefore, if you are financing the co-op with a mortgage, you aren’t required to get title insurance.

However, your real estate lawyer will protect you by conducting a co-op lien search on your behalf. While less common and not required, there are insurance policy options for buyers in co-ops called leasehold title insurance. This is an added layer of protection if you like to feel more secure. Just ask a title agent.

What Are the Two Parts of Title Insurance?

Title insurance consists of two parts: the lender’s policy and the owner’s policy.

The Lender’s Policy

The lender’s policy covers the lender’s interest in your property and purchase price. The policy protects the lender and title claims that affect the lender’s loan to you. It also protects the lender against any outstanding liens and other defects associated with the property.

affect the lender’s loan to you. It also protects the lender against any outstanding liens and other defects associated with the property.

If a lawsuit against the lender occurs, the policy will compensate the lender.

The Owner’s Policy

The owner’s policy protects the homeowner and covers the entire sales price of the apartment if you somehow lose equity. It also saves you from fraud, errors, disputes that may come about, and any legal fees attached to these encumbrances.

The coverage doesn’t decrease over time.

What Does the Owner’s Title Insurance Cover?

Since a title company can’t always catch every error in a title, here’s what title insurance for the owner or homebuyer covers:

- Forgery or fraud

- Undisclosed heirs to the property

- Inconsistent wills

- Liens that precede the new homeowner

- Defective paperwork, like improper recordings from escrow and closing

- Missing information

- Transfers of the deed determined to be illegitimate

How Do You Get Title Insurance?

Your real estate attorney will help you get title insurance, an integral part of the closing process, and the contract documentation. In NYC, it is customary for your real estate attorney to help you organize title insurance as part of their guidance through the contract documentation and closing process.

Real estate attorneys typically select the title company as they know whom to trust. You also have the right to choose the company’s title if you have someone you prefer.

Most NYC attorneys will select a title company from a preferred list of title insurance companies they know and trust. To be safe, it is always wise to ask your attorney to disclose if they have any conflicts of interest with the title company – such as an ownership interest. As a buyer, you can select the title company if you prefer.

How Much Is Title Insurance in NYC?

Title insurance costs are high in NYC and can be thousands of dollars. It is one of the highest closing costs for those buying a condo or a townhouse in New York City. GFE quotes show that fixed and variable fees adjust with the purchase price.

Specifically, the title insurance rates will cost around 0.4% to 0.45% of the purchase price. However, the exact amount will vary by the title insurer and the specifics of each sale. Unlike a health insurance policy, title insurance is not paid monthly but once by the homebuyer during closing.

That may be difficult for some homebuyers, but the expense can be rolled into all the closing costs.