2022 NestApple Guide to NYC Buyer Closing Costs

Go Back To Previous PageWhen you thought buying an apartment in NYC couldn’t get any more complicated or costly, you started to think about closing costs. The sheer number and size of a buyer’s closing fees in NYC can be overwhelming and, at worst, a deal-breaker, so it’s essential to have a rough sense of how much closing costs are in NYC before looking at apartments. Many people do not think about closing costs when purchasing a home. Find out how to calculate your potential closing costs in New York and what you can do to lower some of the expenses. While the already expensive cost of buying a condo or co-op in NYC makes it hard to live in NYC, there are other fees you will need to deal with during the closing that you may not have even thought of or budgeted for.

Since these additional fees may be a game-changer when buying a place in NYC, it is crucial to understand these extra costs and their purpose to be better prepared when buying your dream home.

What Are Buyer Closing Costs?

Buyer closing costs get tacked on after you agree on a price with the seller. It includes taxes, fees, and services charged by the government, bank, management company, insurers, and your attorney.

Different fees apply to other types of transactions, which can be significant.

- On the low end – say an all-cash co-op under $1,000,000 – fees could be as low as a few thousand dollars.

- Meanwhile, if you’re financing new construction, buyer closing costs are easily 5% of the purchase price and can even get over 6%.

Most buyer closing costs are cash costs. In other words, you won’t be able to roll them into the mortgage. This can significantly increase the amount of cash you need to bring to the table. For example, buyer closing costs of “just” 2% of the purchase price would still require a typical buyer with financing to bring 10% more cash to the closing table.

cash you need to bring to the table. For example, buyer closing costs of “just” 2% of the purchase price would still require a typical buyer with financing to bring 10% more cash to the closing table.

While we recommend all buyers read this post first, you can estimate your closing costs using NestApple’s closing cost calculator.

What Closing Costs Does the Buyer Pay For?

The buyer’s closing costs are all the taxes and associated fees you must pay for your purchase. Some expenses are similar to the seller’s closing costs, and some are entirely different. These fees and expenses become higher with home purchases requiring financing because of all the mortgage closing fees.

When it comes to putting extra money aside for your closing costs, we recommend setting aside:

- Approximately 2-4 % of the sales price of the co-op, condo, or townhouse you purchased.

- If the co-op or townhouse costs over a million dollars or you’re buying a condo, you will want to save more – about 3-4% of the purchase price.

- If that condo you bought is brand new, bump that number to 5% of what you paid.

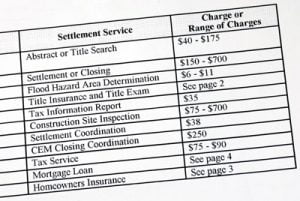

Many of the associated buyer’s closing costs may include some or all of the following:

- Lender fees for processing and finalizing your loan

- Appraisal fees

- Inspection fees

- Credit search charges

- Title search charges

- Real estate attorney fees for closing

- Transfer taxes (sometimes)

- Prepaid property taxes

- Prepaid taxes

- Prepaid interest

- Homeowner’s insurance

NYC Mansion Tax

An additional real estate transfer tax applies on property purchases equal to or greater than $1,000,000. The mansion tax is probably the best-known buyer closing cost in NYC. Until 2019, the mansion tax was a simple 1% of the purchase price for any real estate transaction of at least $1,000,000. In March 2019, the tax authorities increased rates for transactions $2,000,000 and up.

buyer closing cost in NYC. Until 2019, the mansion tax was a simple 1% of the purchase price for any real estate transaction of at least $1,000,000. In March 2019, the tax authorities increased rates for transactions $2,000,000 and up.

It’s important to note that the mansion tax is binary. It’s $0 if you buy an apartment for $999,999 and $10,000 if you buy one for $1,000,000. This is why seeing an apartment close to $1,000,000 is infrequent. It applies to all real estate types—co-ops, condos, and houses.

However, if you’re looking at an apartment just over the $1,000,000 threshold, you might be able to get back under it with a commission rebate, as it’s treated as a reduction to the purchase price.

Mortgage Recording Tax

The mortgage recording tax requires purchasers in NYC to pay

- 1.8% on mortgage amounts under $500,000 and

- 1.925% on mortgage amounts above $500,000.

This tax is based on the mortgage amount, not the purchase price, and applies to mortgages related to real property, such as condos or homes. It does not apply to co-ops as they are a different form of ownership.

not apply to co-ops as they are a different form of ownership.

No deed, no real property, no mortgage recording tax. According to New York State, it is “a tax on the privilege of recording a mortgage on real property located within the state.” In New York City, the mortgage recording tax is

- 2.05% of the mortgage amount if it’s less than $500,000

- and 2.175% if it’s $500,000+.

The good news is that your lender usually chips in 0.25%, so your net responsibility is 1.8% or 1.925%, respectively. Even smaller good news is NYC throws in the first $30! We’re unsure if that’s supposed to be a joke, but money’s money. If you’re financing 80% of your purchase, the mortgage recording tax will be about 1.5% of the purchase price, so it’s significantly more significant than the mansion tax!

Reduce the Mortgage Recording Tax with a CEMA

Even if looking at a condo, you can avoid some mortgage recording tax with a CEMA. A CEMA is when you take over the seller’s existing mortgage, which requires negotiation and a lot of paperwork, so explore that possibility early in the transaction.

The mortgage recording tax is not only for NYC but is significantly higher than the tax amount charged in other counties in New York. For example, Westchester County’s total mortgage recording tax is just 1.3%.

In other New York counties, the mortgage recording tax is usually 1% or 1.25%; however, some counties, such as Ulster and Madison, charge as low as 0.75%. You can review the tax tables on Form MT-15, commonly called the mortgage tax return.

Title Insurance

While not as significant as the mortgage recording tax, title insurance is another buyer closing cost that sneaks up on buyers because it’s not well known. Title insurance protects the buyer (and their lender) from claims on the property. What could that mean?

Say the seller renovated their kitchen but never paid the contractor. The contractor now has a claim on the property. The contractor might file a construction lien with New York State on the property. Theoretically, this would be discovered during due diligence, but things happen – it wasn’t initially appropriately filed, the state lost it, your attorney missed it, etc.

A title insurance policy protects buyers from this type of claim after closing.

Remember, in the example above, the lien was on the property—not with the seller—so the lien would be your problem once you close. A simple way of summarizing title insurance is that it ensures you’re buying the apartment and only the apartment. If there are any unwelcome surprises down the road, you’re covered. A title insurance policy lasts as long as you own the property and costs about 0.4% of the purchase price.

When buying a condo, you will always be required to purchase title insurance for various reasons. However, buying title insurance on co-ops is rare as you are not buying real property.

Attorney Fees

Given the magnitude of the items above, buyers will be happy to know their attorney will be one of the smaller buyer closing costs. Unlike most other attorneys, real estate attorneys typically charge per transaction, not hourly. Whether your purchase is a breeze or contract negotiation gets complicated and drags out for weeks, the price does not change.

Ballpark real estate attorney rates are $2,500 to $4,000 per transaction. Some charge a few hundred bucks, and others get over $5,000. When choosing an attorney, they must conduct thorough due diligence and look for your best interests regardless of price. Technically, every attorney should, but NestApple negotiated transactions where attorneys cut corners.

Purchase Application Fees

While not material, purchase application fees are more obnoxious buyer closing costs. When your condo or co-op application is submitted, fees will be associated with processing it. Most applications require a processing fee, credit check, financing, and move-in fee. Before you make an offer on a property, you can request a copy of the purchase application to know what you’re looking at, but expect to pay $2,000 – $3,000 for these odds and ends.

We’ll also throw financing fees into this section, similar to application fees. Your bank charges financing fees to execute your mortgage, including application fees, appraisal fees, and the bank’s attorney. All in, plan on around $2,000 for financing fees. NYC home buyers who will be financing the purchase can also expect to pay most, if not all, of the additional costs below:

- $750 – Bank Attorney Fee

- $750 – Bank Loan Origination Fee

- $450 – Property Appraisal Fee

- $500 – Mortgage Application & Processing Fee

- $100 – Credit Report & Employment Verification Fee

- $1000 – Title Search & Recording Fees

- $200 – Financing / Recognition Agreement Fee (Co-op only)

Other Closing Costs?

Sometimes, sellers will try to pass their closing costs on to you. With new developments, sellers expect you to pay transfer taxes and other fees; this should not surprise you. At 1.825% of the purchase price, transfer taxes are significant. Also, new development closing costs can easily be 2% more than resale costs for other items.

Flip Tax

Suppose a seller asks you to pay something else, like a flip tax, that should have been disclosed from the start. Unscrupulous sellers and agents sometimes slip these into the deal sheet after accepting an offer. This is the equivalent of raising the price and is not acceptable.

If you are in such a situation, talk to your broker and attorney. They’ll be able to tell you if the seller is trying to pull a fast one. A flip tax is a seller’s closing cost.

Are Buyer Closing Costs Tax Deductible?

The short answer is no – most buyer closing costs are not tax-deductible. Taxes such as the mansion and mortgage recording tax may be added to your cost basis and thus shield capital gains when you sell. Please talk with your accountant to determine specific closing costs and see how they apply to your situation.

Most buyers will find that real estate’s main impact on their tax return will be mortgage interest and property taxes, which will become less so after the 2017 tax reform.

How Can You Reduce Buyer Closing Costs in NYC?

It’s pretty much impossible to avoid most closing costs, but there are steps you can take to minimize them. The easiest way to save on closing costs is to focus on co-ops. You’ll avoid the mortgage recording tax and title insurance with a co-op. Right there, you’ve saved about 2% of the purchase price.

And while the government is not going to negotiate, everyone else might. Will your bank waive that application fee? Could your attorney take $250 off their fee?

You won’t find out unless you ask. These improvements won’t move the needle, but they’re small victories!

The most effective way to reduce closing costs is to ask your real estate agent for a commission rebate. Buyer broker commissions are almost always 2.5% or 3% of the purchase price, so even if you only get a small portion of that, it can offset a large chunk of your closing costs in NYC! Most buyers are unaware that this is an option, so even if you don’t work with NestApple (although we hope you do!), ask for a rebate.