Average Down Payment for an Apartment in NYC

Go Back To Previous Page Buying an apartment in New York City is a slice of the American dream. It means getting the apartment life you want in one of the greatest cities in the world, whether looking in Manhattan, Brooklyn, or Queens. Saying that owning an apartment in New York City is a good investment is an understatement. It may be the best investment you’ll ever make in your life. You will need a down payment to get the apartment of your dreams. The amount required might shock you. The average down payment in NYC is 20% of the purchase price. You can put down 10% or less on many condos in the city. Most co-op apartments have stricter financial requirements, which typically require a minimum down payment of 20%.

Buying an apartment in New York City is a slice of the American dream. It means getting the apartment life you want in one of the greatest cities in the world, whether looking in Manhattan, Brooklyn, or Queens. Saying that owning an apartment in New York City is a good investment is an understatement. It may be the best investment you’ll ever make in your life. You will need a down payment to get the apartment of your dreams. The amount required might shock you. The average down payment in NYC is 20% of the purchase price. You can put down 10% or less on many condos in the city. Most co-op apartments have stricter financial requirements, which typically require a minimum down payment of 20%.

Condo buildings in NYC often have minimum long-term financing requirements as well. What is the typical down payment for a house or apartment in NYC?

How Much Should You Put Down For A New York City Apartment?

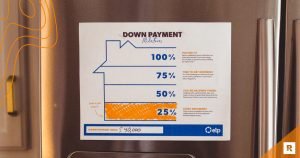

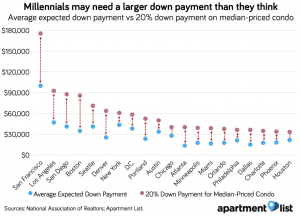

New Yorkers love their apartments so much that a typical down payment might exceed what most people would put down for a house in other parts of the country. Because of the high demand for apartments to rent, a typical down payment for an apartment purchase is 20 percent.

put down for a house in other parts of the country. Because of the high demand for apartments to rent, a typical down payment for an apartment purchase is 20 percent.

Sometimes, 20 percent is not a sufficient down payment, especially with co-ops. In this case, you may need to pay a minimum of 30 percent or more.

Since the median price for all Manhattan apartments is around $916,000, you should expect to pay an average down payment of $183,200.

Is It Possible To Pay Less Than 20 percent for an NYC Apartment downpayment?

While 20 percent down is the benchmark for most apartments, condos, and co-ops, this percentage is not the minimum. If you have an FHA 203k loan, you may be able to put down as little as 3.5 percent. This usually only works in areas approved for FHA loans. It focuses on affordable housing for low to middle-income families.

FHA 203k loan availability

This issue is that apartments like these tend to be in short supply. Therefore, there is a high demand with little to go around.

Some condos also allow you to apply for a home for as little as 10 percent, but your chances of getting approved are slim. Those are FHA 203 k loans.

Why Are Sellers Rejecting Offers With Low Down Payments?

In the past, sellers were far more amenable to selling their homes for a low down payment in NYC. However, times have changed, especially over the past two years. Several reasons explain why sellers might turn their noses up at low down payments. These include:

- They worry that the installment loan will fall through at the last minute. Lenders and credit unions can be fickle. While a preapproval usually leads to an approved loan application, it’s not a guarantee.

Lenders often decline approval because of low down payments. Should this happen, the seller will have wasted their time. A higher down payment could usually prevent the loan from being approved, so they’ll choose the higher down payment. Banks charge origination fees.

- A high down payment suggests more commitment. This is a subjective thing, but it remains a typical assumption. A high down payment means you’re willing to go all-in on a home and do what it takes to get the bid.

- Many sellers also believe a high down payment in NYC is a good sign of your financial health. Having that amount of money means you know how to manage your finances effectively. This alludes to a better debt-to-income ratio, which means they are confident that you’ll be able to handle the house in a pinch.

- Some sellers also worry about your financial stability during times of upheaval. Because of COVID-19 and the Great Recession, many deals have been terminated. Offering a down payment often gives lenders and sellers peace of mind, as they know your job will stay intact.

Can You Use a Gift as a Down Payment?

You can buy it, but there are pros and cons. If you are lucky enough to have a wealthy uncle willing to lend you a substantial amount of money, you can use it as a gift for the down payment on your single-family home. However, there’s a catch. In addition to the gift of liquidity, you must still demonstrate financial health.

Additionally, anyone who wishes to use a gift from a friend or family member as a down payment must obtain a letter. This letter should say that the money is a gift for the down payment.

To use that cash, understand that you’re still responsible for the rest of your expenses.

Essential Tips For Coming Up With A Down Payment in NYC

To buy a home, you must assemble a down payment. However, it’s not as simple as gathering the money. A little strategy goes a long way. The following tips will help give your finances the boost you need:

- Do try to put down as much as possible, but don’t forget to account for those closing costs. Although down payments will get your foot in the door, having an emergency scramble to cover closing costs like moving or taxes can make things rough. To make things easier, use a closing cost calendar to determine how much you should set aside.

- Consider a bridge loan. Don’t have enough money for a down payment? You may be able to obtain a small loan to “bridge” the gap between the price of your home loan and the amount you need for a down payment.

- This generally requires you to have equity, and this lump-sum short-term loan is meant to be paid off once your first apartment is sold. Some buyers also use home equity lines and equity lines of credit.

- Ask for a lower price and use less of your down payment money when in doubt. If you get a counteroffer, you can increase the down payment to sway your lender. Otherwise, you would be out of luck.

- You may qualify for a down payment assistance grant even with a modest income. New York City offers several major programs that can assist you. You can learn more at the New York City HUD.

What Happens If You Can’t Afford A Large Down Payment in NYC?

What is the down payment for an apartment or house in NYC? If the down payment price tags in New York City scare you, you’re not alone. While it may be harder to find a willing seller, there is still a chance that you can obtain the apartment you want to own.

There are two key steps most aspiring homeowners can take. Apply for assistance or pay mortgage insurance.

Expect to be at a loss when you hear how much the down payments can be. Consulting with your mortgage loan officer and real estate agent can help you determine your next step.

Buying an apartment in NYC without a 20% down payment is demanding. Some programs or loopholes may allow it, but they are rare. The Gasdaska Conlon Team usually likes to be positive and help our readers explore their options. However, we do not feel right putting a spin on this situation.

If you’re not in a position to put a 20% down payment on an apartment AND have at least six months of expenses in liquid assets after the closing of the home, you aren’t in a position to safely buy a home in Manhattan. We strongly recommend working hard and saving until you can put 20% down without jeopardizing your household’s financial stability.