What Is The Average Utility Bill For An Apartment In NYC?

Go Back To Previous PageApartment living is generally cheaper than buying a home in New York City, but that does not mean it’s cheap. New York is still one of the most expensive places to live in America. When figuring out your budget, it’s essential to factor in the hidden costs of living in the city. The highest hidden price you will have to pay is the utility bill. As expected, utilities will be more expensive in New York than in the rest of the country. But what can you wish for a typical utility bill? We will discuss the average apartment’s monthly utility bill in NYC.

country. But what can you wish for a typical utility bill? We will discuss the average apartment’s monthly utility bill in NYC.

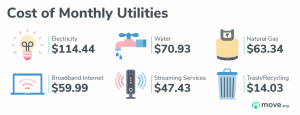

The Average Utility Bill For NYC Renters

New York renters pay $273.95 per month for essential utilities such as water, gas, and electricity. To get additional utilities like a cellphone and internet service, you may have to add $135 to $150 to your bill, bringing the total to approximately $423 on average.

Does that seem expensive to you? That’s because it is. However, this isn’t the whole picture. You need to consider other factors when you’re calculating your apartment utility bills.

What Kind Of Factors Increase Or Decrease Your Average Monthly Utility Bills?

A couple of factors must be considered when considering your utilities. How you manage these things can change how your life in NYC pans out, not to mention how much you pay month-to-month.

- The Size of Your Apartment. In most cases, a studio will require less electricity and heating than a one-bedroom. A one-bedroom will need

less energy than a three-bedroom, and it’s just keeping your place powered.

less energy than a three-bedroom, and it’s just keeping your place powered. - Green Appliances. If you have “green” appliances like energy-saving refrigerators and upgrades like insulated windows, you will enjoy lower utility bills throughout the year.

- Government Programs. NYC’s HUD has several programs to make utilities more affordable for low and middle-income families. You can check them out by dialing 211.

- Apartment Offers. If your apartment offers free heat and hot water, you won’t have to pay as much as you would if you had none of your utilities covered. Choosing a suitable apartment, therefore, is part of a bill-lowering strategy.

How Much Should You Factor In For Food?

Honestly, this depends on what you want to eat and how many people are in your family. You should expect to pay 10 percent more for food than a typical American.

However, that’s not the entire story. Depending on where you buy your food, a gallon of milk that costs $3 in one place could cost $5. Food shopping is strategy-based in New York.

What Other Major Bills Should You Prepare For?

The other two significant bills that might take a chunk of your paycheck include taxes and entertainment.

New York City’s taxes are incredibly high compared to Kentucky, but you get a lot for what you pay. Even so, you may have to talk to an accountant to see how much you should expect to owe once the tax year ends.

see how much you should expect to owe once the tax year ends.

NYC is an entertainment town with many attractions that people love. We suggest that you expect to spend at least $4,000 per year on entertainment.

Need Help Figuring Out Your Budget?

Each borough has its ups and downs, so it’s good to have a real estate agent and brokerage understanding your needs. At NestApple, we make it possible to get the advice you crave and the home that suits your needs. Give us a call today.