2025 Tax Benefits for Investment Properties in NYC

Go Back To Previous PagePurchasing an investment property is an efficient way of receiving some passive income. However, investing in NYC remains attractive, given the high rental income  that it entails. Investors and owners struggle with the costs of buying, owning, and operating real estate in NYC. Therefore, there are many tax programs to keep the market robust. What are the tax benefits for investment properties in NYC?

that it entails. Investors and owners struggle with the costs of buying, owning, and operating real estate in NYC. Therefore, there are many tax programs to keep the market robust. What are the tax benefits for investment properties in NYC?

Tax benefits for investment properties

- Tax Benefits for Investment Properties and tax exemption programs exist to incentivize investment and real estate growth.

- Most tax programs for rental investments are tax abatements. Those property tax abatement programs include Green Roof Abatement, PILOT, NYCIDA’s 421 plans, and J-51.

- Other tax exemptions include 1031 Exchange, REAP, and AIRS. 1031 Exchanges involve many commercial or residential investment properties within a strict time frame.

- Lastly, the most straightforward tax deduction remains property depreciation.

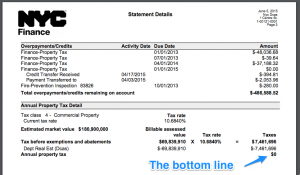

PILOT agreements (Payment instead of Taxes)

With this option, known as a PILOT program (or Payment-In-Lieu-Of-Taxes), commercial property owners can make federal payments to their city and state. The PILOT program  incentivizes property owners looking to renovate or build from scratch. A PILOT designates a payment to the authorities to repay the lost property tax money. These developers can benefit from tax advantages through certain agreements.

incentivizes property owners looking to renovate or build from scratch. A PILOT designates a payment to the authorities to repay the lost property tax money. These developers can benefit from tax advantages through certain agreements.

Therefore, these properties are exempt from property taxes if they make a “payment in place of taxes.” The PILOT program won’t decrease NYC property taxes, and the amounts will be the same rate as when the authorities first assessed the property. Also, only real estate taxes will apply, and personal property taxes will not change.

The NYC IDA (Industrial Development Agency) and the NYC EDC (Economic Development Corporation) issue these permits.

NYC IDA / NYC EDC

The New York City Industrial Development Agency also provides tax abatements to support business growth and relocation. NYCIDA offers incentives, including  tax benefits for investment properties, such as a reduction on property tax for up to 25 years and waived city and state sales taxes.

tax benefits for investment properties, such as a reduction on property tax for up to 25 years and waived city and state sales taxes.

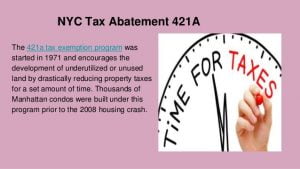

421a tax abatement

A 421a tax abatement helps developers lower property taxes for 10 to 25 years, and the developer applies credit toward the total taxes owed. Created in 1971, regulators designed the 421a tax abatement program to encourage NYC developers to build new residential buildings on unused land.

In 2017, the 421a tax abatement program was renamed Affordable New York. The program also focuses on affordable housing, and indeed, the guidelines include affordability areas in the five boroughs.

Properties with over 300 residential units became eligible for a 100% tax abatement for up to 3 years during construction and 35 years after construction. You may also qualify for this tax reduction if you recently renovated a multi-family residential building. However, the advantages can differ depending on location, business characteristics, and eligibility for affordable housing. If the construction project continues to qualify, the tax break will go with the property if it is sold.

reduction if you recently renovated a multi-family residential building. However, the advantages can differ depending on location, business characteristics, and eligibility for affordable housing. If the construction project continues to qualify, the tax break will go with the property if it is sold.

To start the application process, one must apply to the NYC Department of Housing Preservation and Development (HPD).

ICAP

The ICAP (Industrial and Commercial Abatement Program) provides abatements for property taxes for up to 25 years. Eligible properties include commercial and industrial buildings (built or renovated). ICIP, previously known as the Industrial Commercial Exemption Program, turned into ICAP when ICIP’s program was over in 2008.

AIRS program

The AIRS (Affordable Independent Residences for Seniors) Program replaces the “non-profit residence for older people.” This program allows not-for-profit and for-profit businesses to develop affordable housing for older people. The AIRS program provides extra space if a developer creates affordable housing for older people.

J-51 exemption and abatement

A J-51 abatement is a tax exemption that puts a hold on the property’s assessed value before construction starts. Therefore, it decreases your property tax on a dollar-for-dollar basis. The J-51 tax abatement program was initially established in 1955 to encourage landlords to install hot water plumbing in their buildings.

Today, authorities have expanded the program to include significant capital improvements such as window replacements, elevator overhauls, and facade work. To qualify, you must renovate the property. Alternatively, you can turn a commercial or industrial building into a residential one.

Affordable housing projects can receive benefits lasting for 34 years. Thirty of those years benefit from full tax benefits for investment properties. The remaining four years are the phasing-out period. All other projects receive the 14-year exemption program, with 10 years being full benefits and a 4-year phase-out period.

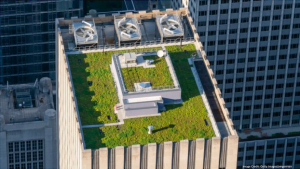

Green roof abatement

This tax advantage offers a one-time-only credit for properties with green roofs. The tax reduction equals $4.50 per square foot of green roof space. The benefits are limited to at least $100,000 or the cost of property taxes due for the property. You can get additional sales tax exemptions using a solar energy system.

at least $100,000 or the cost of property taxes due for the property. You can get additional sales tax exemptions using a solar energy system.

- Requirements: The property must be in 1, 2, or 4 classifications. At least half of the roof must be covered by a green roof.

- Exclusions: If you receive the following, you cannot benefit from this tax benefit: ICAP, 421-a/b/c, PILOT.

REAP

The “Relocation and Employment Assistance Program” provides business taxes for employees who relocate from outside NYC or below 96th Street in Manhattan to properties  above 96th Street.

above 96th Street.

- Eligible Businesses: The business has to reposition at least one employee from outside the REAP area to an approved location. The company has to prove that it has dealt with operations outside NYC or lower than 96th Street in Manhattan for at least two years before relocating.

- Benefits: With REAP, companies receive a credit of $3,000 per year for 12 years for each employee to relocate to a specified suitable location as zoned by the city. Alternatively, companies receive a yearly credit of $1,000 per share when relocating to parts of the available area that are not revitalization areas.

1031 Exchange: the #1 used tax benefits for investment properties in America

The 1031 Exchange is a tax deferment scheme to defer taxes during property transfer. Defined by Section 1031 within the Internal Revenue Code, the regulator created the 1031 Exchange with the design that the investor may still have their cash involved in the investment and may not have enough money to pay taxes.

taxes during property transfer. Defined by Section 1031 within the Internal Revenue Code, the regulator created the 1031 Exchange with the design that the investor may still have their cash involved in the investment and may not have enough money to pay taxes.

This law gives an investor the right to defer paying capital gains taxes on a sold investment property if he purchases another property equal to the property with the money from the first property.

Therefore, the real estate investor avoids capital gains. The taxpayer hires a trusted intermediary to watch over the funds until the transaction is completed. The property must be an investment.

Qualifications for 1031 tax deferral

- The property must be exchanged, not sold.

- Both properties exchanged and received are for rental, investment, or use in a trade or business.

- The received property remains similar to the property transferred.

- The investor must identify the new property within 45 days and receive it within 180 days or after transferring the sold property.

What happens if you have multiple properties to exchange?

An investor can buy more than one property for replacement, but to do so, they must meet one of these rules: the 3-property rule, the 200% rule, or the 95% rule.

The investor can identify no more than three potential properties. Under the 200% rule, their total value does not go over 200% of the property released. If the full fair market value equals 95% or more of the replacement properties, then the investor can specify any numerical amount of replacement properties.

The four types of 1031 exchanges

Investors can choose between four like-kind exchanges: simultaneous, delayed, construction/improvement, or reverse.

- A simultaneous exchange is designated when the closings of the” new” and old properties close on the same day.

- A delayed exchange is the most popular among investors because the benefit is prolonged. An investor has up to 45 days to identify the new property and 180 days to close.

- Reverse Exchange or forward exchange happens once the investor has brought the replacement property via an exchange accommodation titleholder before exchanging the property owned.

- Construction or Improvement Exchange: This exchange gives investors the right to renovate their replacement property before closing.

The simplest way to get tax benefits for investment properties

Knowing the various programs you can save money on your investment can help  you make even more money. Therefore, you can get creative with saving on taxes, whether that means making your PILOT, tax abatement programs like 421a or J-51, or a property exchange (1031).

you make even more money. Therefore, you can get creative with saving on taxes, whether that means making your PILOT, tax abatement programs like 421a or J-51, or a property exchange (1031).

However, the most efficient way to save on taxes is to do nothing! The IRS considers depreciation when calculating taxes on your investment, and a good chunk is exempt when paying residential or commercial property taxes.

How much can you depreciate from your residential rental property?

You must take the purchase value and subtract the value of the land (since you cannot depreciate land). Then, you can divide that net amount by 27.5 years. For example, if the total depreciative value is $1 million, you divide that by 27.5 years.

Therefore, the annual exemption is $36,363.64. For example, if you receive $4,500 monthly (or $54,000 annually from rent), you can deduct $36,363.64, making your taxable income $17,636.36. That is not factoring in other deductions like property taxes, insurance, and HOA.

In conclusion, your taxable income comes out to be very small or negative.

How much can you depreciate from your commercial property?

An investor can depreciate a property further at 39 years for commercial properties. Therefore, you subtract the value of the actual land from the purchase price to obtain the building’s depreciative worth. For example, an annual deduction of $8 million for a building comes to $205,128.

Should you apply for tax programs for your investment property?

Buying an investment property in New York is expensive, and renovation and improvements add up. Therefore, tax  incentives and abatement programs are efficient on the federal and local levels, making owning and maintaining an investment more feasible and profitable.

incentives and abatement programs are efficient on the federal and local levels, making owning and maintaining an investment more feasible and profitable.

The most straightforward tax deductions come from depreciation; you can realize more tax benefits for investment properties by utilizing one or more programs mentioned in this article. It could be as simple as installing solar panels, taking advantage of the green roof abatement, or applying for a J-51 while improving your property.