Own a rental property under my name or under an LLC?

Go Back To Previous PageDo you need a limited liability company (LLC) for a rental property in New York City? This blog will analyze the benefits of establishing an LLC in NYC real estate. We will go over the common issues about this ownership structure. In the past, you probably rented an apartment. You probably noticed that the management company or landlord asked to send checks to a company rather than an individual landlord. Usually, it’s followed up by an LLC; it’s not random. We will discuss the benefits of owning real estate in an LLC. More and more landlords are getting an LLC for their rental property. This simple structure can significantly affect how landlords operate and their tax bills. If you own your rental property, you might have been thinking about it. We will go over an analysis of using LLCs for rental investment.

ownership structure. In the past, you probably rented an apartment. You probably noticed that the management company or landlord asked to send checks to a company rather than an individual landlord. Usually, it’s followed up by an LLC; it’s not random. We will discuss the benefits of owning real estate in an LLC. More and more landlords are getting an LLC for their rental property. This simple structure can significantly affect how landlords operate and their tax bills. If you own your rental property, you might have been thinking about it. We will go over an analysis of using LLCs for rental investment.

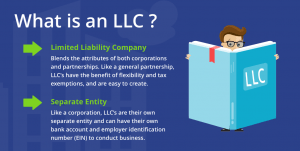

What does LLC stand for?

An LLC stands for Limited Liability Company, a legal entity ruled by a written LLC operating agreement.

One or more people can own this structure.

Owning real estate in an LLC entails separating your rental investment from yourself. This type of ownership can also have tax consequences.

Therefore, owning an LLC can be a sole proprietorship or joint partnership.

Do I need to buy a rental property via an LLC in real estate?

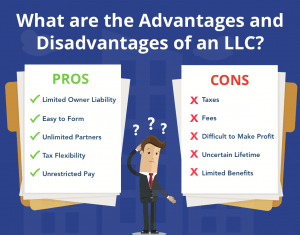

If you own a rental property under your name, you may wonder whether having it under an LLC is better. LLC in NYC real estate is  becoming the standard business format for landlords. However, it’s not mandatory at all to own an investment property in an LLC.

becoming the standard business format for landlords. However, it’s not mandatory at all to own an investment property in an LLC.

However, it offers the following advantages:

Separation of assets

If an accident happens in the unit and your tenant decides to sue you, the LLC will separate this property from your assets. Another example is if the bank or the IRS seizes your assets, this LLC creates a separation in court and mitigates the risks.

You expose yourself to more significant risks if you own various rental properties under your name. Tenants or creditors can sue you directly rather than the LLCs you created. This mistake can lead to massive losses across your assets.

If you manage several multiple rental units

Having several LLCs limits your liability. This structure protects the properties from being held liable altogether. If one unit goes bankrupt, it insulates this property from the rest. This structure limits the risk of potential losses at the level of each property.

Liability reduction with LLC in real estate

People cannot sue you directly when you own assets vis an LLC; instead, they can only sue the LLC. If the LLC carries a mortgage, the only exposure and liability are limited to the equity in that LLC. The responsibility of the LLC is “limited,” and they can’t reach you.

Taxes benefits with LLC in real estate

Because of the LLC, you get the benefit of pass-through taxation. LLCs make it easier to deduct business expenses, and LLCs are separate entities that make it easier for you to determine the earnings and profitability of the investment.

Use of new services

You can receive rent through credit card payments or e-payments. When opening accounts, you can apply for a business credit card and benefit from those generous offers. Remember, it is not mandatory.

We recommend our clients do it because we think it’s a smart move for their rental property, but nothing says you have to do it.

Can I create an LLC for my property if I already have a mortgage for my rental investment?

benefits of putting real estate in LLC

Yes, but it can make things messy. You must contact your bank to ask if you can transfer the property title to the LLC. The bank may not approve the transfer or change the mortgage terms.

Interest rates are usually higher for most lenders when facing an LLC vs. an individual borrower.

You must speak with your tax specialist and accountant to initiate this transfer.

Can I buy a house under an LLC and rent to myself?

We do not recommend that clients initiate this structure. Even if it sometimes makes financial sense, there’s a caveat.

This self-rental structure often represents a red flag for the IRS.

The IRA’s name is “phantom income.” It typically designates a tax gain not yet realized through a cash sale or a distribution.

This montage can complicate tax planning and make your tax revenues more challenging. There are exceptions when that structure makes sense, but be ready to face an IRS audit!

How to create an LLC and then transfer a mortgage to the LLC?

Owning real estate in an LLC

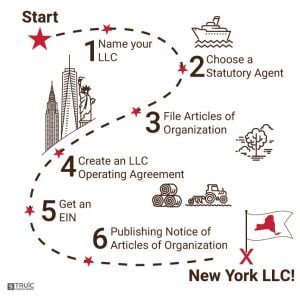

Your accountant needs to file the proper paperwork with the state. You need to develop the right name for your company and explain how it works. An attorney is in charge of filing articles of organization and will provide you with an affidavit of publication.

- Contact your bank to ask how to transfer the mortgage title from the individual to the LLC. Some lenders won’t approve it, and others will give you the requirements for the assignment.

- Create a name and draft the LLC’s Articles of Organization (AOC). The AOC details the structure and explains it to the authorities.

- If you live in a “Notice of Intent” state like New York, we recommend filing a notice of intent. This document states you are creating an LLC.

- Next, you will need to file all the licenses for your LLC.

- Finally, you can file for an LLC. The paperwork can cost between $100 and $1000, depending on the location.

- Then, administratively, you must transfer ownership to the LLC and create a new bank account. This separate account will make the accounting and tax process easier once a year.

- Finally, you need to update your leases. Tenants will sign a new lease with the LLC and make their checks payable to the LLC.

How much does an LLC in real estate cost to set up and run?

Depending on the location, the LLC will cost anywhere from $100 to over $1,000. It will also cost about the same to pay annually to keep the LLC in NY and file the paperwork.

In what case shall I create an LLC for rental units?

We recommend our clients get financing for their LLC when they close on a rental property. Transferring the title of the property and the mortgage in the middle of the mortgage can be a painful exercise. In various cases, it makes a lot of sense to own rental properties via individual LLCs:

in the middle of the mortgage can be a painful exercise. In various cases, it makes a lot of sense to own rental properties via individual LLCs:

- Suppose you are just starting to invest; the sooner, the better. It is an excellent habit to take.

- If you buy a second property and expand, each property needs its LLC.

- If you want to renovate, hire staff LLCs to make the hiring process more manageable and streamline the accounting process under each umbrella.

- A lawsuit can make you spend a lot of money and go bankrupt. Conversely, having your losses limited to the LLC equity can be beneficial. You can lose your rental property, but it’s not the world’s end. In the case of litigation, getting an LLC is the safest way to protect yourself.

Are there instances when an LLC in New York real estate is bad?

We do not recommend forming an LLC if the goal is only to rent from yourself, as this will raise red flags with the IRS.

The IRS can requalify the cash flows of this real estate transaction into income.

Conclusion about LLC in NYC real estate

Generally, forming an LLC in NYC real estate for a rental property is a bright idea as it limits your liability.

Nevertheless, setting up an LLC can be expensive and increase your closing costs. Therefore, at NestApple, we think the benefits of an LLC vastly outweigh the pitfalls. Their most significant strength is separating assets to help alleviate tax burden and liability, but they can also act as a convenient way to keep finances separate.

If you aren’t sure whether it’s for you or need help setting one up, contact a tax professional or an LLC creation company. They can help!