When investing in rental properties, many investors consider forming a Limited Liability Company (LLC), which provides personal liability protection to its members.

This protection is especially beneficial in areas with a high risk of litigation, such as New York. However, it is essential to understand that creating an LLC is not merely a protective measure; it will impact every aspect of property management.

Why Investors Opt for LLCs

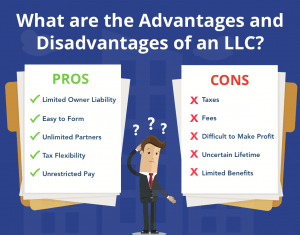

Investors are often drawn to LLCs for various reasons. The most significant advantage is its liability protection, which separates personal assets from business liabilities. This is especially important in today’s unpredictable real estate market.

Besides, LLCs offer attractive tax benefits, allowing profits and losses to pass directly to the members without being taxed at the corporate level. However, these advantages are just the tip of the iceberg regarding what an LLC encompasses.

Closer Look at LLC Advantages

To truly understand why LLCs are favored, it’s essential to consider their flexibility. For example, LLCs offer various ownership structures, accommodating different investment strategies and partnership agreements.

LLCs’ flexibility is desirable to investors working in diverse markets where real estate dynamics vary greatly. Additionally, the privacy aspect of LLCs, which protects owners’ identities, is another factor that many investors consider, particularly in high-profile transactions.

In the next section, we will shift our focus from these general advantages to more precisely examine the disadvantages of using an LLC for rental property investments. This shift is crucial for a well-rounded understanding of the topic, particularly for home buyers and sellers in the 30-55 age demographic who typically seek a balance of security and profitability in their real estate ventures.

Limited Personal Liability: A Double-Edged Sword

There is no Complete Protection

The main attraction of forming a Limited Liability Company (LLC) for real estate investment, particularly for rental properties, is the assurance of limited personal liability. This legal framework is meant to protect personal assets from lawsuits related to the property.

However, this safeguard is not as impenetrable as commonly believed.

Understanding the Limits of Liability Protection

It is essential to understand that even with the protection of an LLC, anyone can still be named in a lawsuit. The limited liability concept has its limitations. Under specific circumstances, such as personal guarantees on loans or suspicion of fraudulent activities, LLC members can still be held accountable.

Bottom Line on Liability

It’s important to understand that even though having an LLC can provide some protection, it’s not always enough to shield against all legal disputes. Investors should always be cautious and mindful of the possibility of personal liability, even when operating within the framework of an LLC. The upcoming sections will explore several drawbacks of using an LLC for rental property investment.

Financial Complexity and Costs

Navigating the Costs of LLC Ownership

Managing an LLC for rental property can be complex and costly. Many overlook the financial aspect, which involves a range of expenses, from initial filing fees to ongoing maintenance costs. These expenses can vary significantly depending on the state in which you are operating.

The Burden of Yearly Maintenance

Maintaining an LLC requires substantial administrative effort. There is an annual LLC fee.

Need for Professional Assistance

Managing an LLC property can be financially complex. As a result, many property owners may need to hire professionals such as accountants or lawyers to ensure compliance with state regulations and assist with financial reporting. However, this can increase operational costs and may require depending on external expertise for essential aspects of property management.

A Lesson in Financial Preparedness

It is essential to understand that forming an LLC for rental property investment requires a thorough analysis of the initial setup costs and ongoing financial and administrative commitments.

Investors must be prepared for these responsibilities and include them in their investment strategy. As we explore the intricacies of LLC ownership, it is crucial to keep these financial considerations in mind, especially for investors who manage multiple properties or operate in different states.

Financing Challenges

The Hurdles of Securing Loans

Investors looking to buy a rental property through an LLC often face difficulties securing financing. There is a common misconception that obtaining a mortgage through an LLC is as easy as getting personal funding, but the truth is that it’s not. This difference can have a significant impact on your investment strategy.

A Real-World Financing Dilemma

Buying a primary residence through an LLC is not straightforward. Obtaining a mortgage is not that easy. However, due to the LLC structure, the bank may view the purchase as an investment property. The buyer faces higher interest rates and a larger down payment.

Investment Property Classification

Banks usually consider LLC-owned properties as investment properties with higher risks than personal mortgages. This perception leads to stricter lending criteria, such as higher interest rates and down payment requirements.

This realization can be shocking for investors, especially those new to the LLC arena. Therefore, it is crucial to consider these financial implications when considering an LLC for your rental property.

Navigating the Mortgage Landscape

It is essential to comprehend the mortgage landscape for LLCs. This is not only about the higher costs but also about the availability of loans.

Some lenders may be reluctant to finance properties owned by an LLC, limiting your options. Therefore, you must explore financing options more thoroughly and possibly establish stronger banking relationships to overcome this constraint.

Preparing for the Financing Journey

To sum up, preparing for the financing challenges of LLC-owned rental properties before investing is essential.

Thorough research, advice from financial experts, and exploring different lending options are crucial steps. Equipping yourself with this knowledge can assist you in navigating the complexities of LLC financing and making informed decisions that align with your investment objectives.

Taxation Complications

Navigating the Complex Tax Landscape of LLCs

The tax implications of owning rental property through an LLC can be more complex than personal property ownership, particularly for multi-member LLCs. Careful consideration is required to avoid unexpected tax burdens.

Multi-Member LLC Tax Filings

For multi-member LLCs, filing entity-level tax returns significantly differs from individual ownership. This requirement adds an extra layer of complexity to the tax preparation process.

K-1 Forms and Personal Tax Implications

If you own an LLC that holds investment property, you may receive K-1 forms that report your portion of the LLC’s income, deductions, and credits. This differs from individual ownership, where rental income and expenses are usually reported directly on your tax returns.

The issuance of K-1s can be unfamiliar territory for many investors, as it introduces an additional layer of tax reporting.

The Disregarded Entity Scenario

It’s important to note that if the LLC is considered a disregarded entity, as with a single-member LLC or particular married couples filing jointly, the LLC’s activities can be reported on the owner’s tax return. This can simplify tax reporting but only applies to specific situations and not all LLC structures.

Tax Preparation and Professional Advice

Seek professional tax advice to ensure that they are compliant. It is crucial to fully understand all tax implications and how they apply to your unique situation.

Conclusion on Taxation

To sum up, although LLCs provide some tax benefits, they also come with a complexity that demands careful planning and expert advice.

Comprehending the tax consequences, particularly for LLCs with multiple members, is crucial to making a knowledgeable decision about structuring your rental property investments. The objective is to navigate these tax laws competently to prevent surprises and take advantage of potential benefits.

Transferability Issues among Disadvantages of an LLC

Challenges in Property Transfer Within an LLC

Owning rental property through a Limited Liability Company (LLC) can present peculiar obstacles when transferring property, be it for selling, estate planning, or changing ownership structure. These challenges often surprise investors, making previously assumed simple transactions more complicated than imagined.

Real Estate Sales and LLC Ownership

Selling a property owned by an LLC can be a complex process. Unlike selling a property in personal ownership, which is relatively straightforward, selling a property in an LLC can involve additional legal steps.

This is particularly true if one needs to transfer membership interests in the LLC rather than the property itself.

Estate Planning Considerations

LLC ownership can complicate estate planning. Transferring LLC-owned property to a trust or heirs involves real estate and corporate law regarding the transfer of LLC membership interests.

Managing Member Approval and Restrictions

It is crucial to remember that in numerous Limited Liability Companies (LLCs), particularly those with more than one member, transferring ownership interests may necessitate the approval of other members. This condition can cause delays or conflicts, especially when members have different objectives or interests.

Impact on Real Estate Investment Flexibility

The transferability issues highlight an essential fact: owning rental property through an LLC can affect the flexibility of your real estate investment. Whether you want to sell the property, plan for the future, or restructure the ownership, the process can be more complicated and time-consuming than personal ownership. This complexity should be a vital consideration for investors, especially those who prioritize flexibility and ease of transfer in their investment strategies.

Navigating the Legal Landscape

To summarize, it’s important to consider the decision to hold rental property in an LLC, as it may impact future property transfers.

Understanding the legal implications and seeking professional guidance to navigate these challenges effectively is essential.

Potential Impacts on Tenant Relations

The Myth of Anonymity in LLC Ownership

Many rental property owners believe that using an LLC will provide complete anonymity from their tenants. However, this is often not the case, as tenants can discover the owner through public records or community knowledge.

Even if you introduce yourself as a building manager or have a third party interact with tenants, the truth about ownership can still be uncovered.

Personal Experience with Transparency

In my experience, being honest and transparent with tenants can foster better relationships.

Tenant Perceptions of LLC Ownership

The perception of an LLC as an impersonal entity can negatively impact tenant relations. Tenants may perceive a property owned by an LLC as less approachable or less easy to contact when addressing their concerns.

This impersonal aspect can hinder building positive relationships with tenants, which is essential for effective property management.

The Importance of Effective Communication

Clear and effective communication and good relationship management are crucial for all property owners, whether individuals or LLCs. Establishing transparent communication channels is always beneficial, even if an LLC owns the property.

Tenants appreciate knowing who their landlord is, and an open and honest approach can help create a more cooperative and harmonious living environment.

Balancing Professionalism and Approachability

Whether operating individually or through an LLC, Landlords must balance professionalism with a personal touch. Landlords can build a positive reputation and improve tenant relations by being fair, approachable, and responsive.

This approach can result in longer tenancies, better property care, and a more positive overall investment experience.

Conclusion on Tenant Relations

Although Limited Liability Companies (LLCs) have some benefits when owning rental properties, they can also create particular issues with tenant relationships. Awareness of these challenges and implementing a plan emphasizing transparency and open communication can help avoid potential problems.

Property owners must prioritize building trust and community with tenants, regardless of ownership structure.

more insight into the disadvantages by drawing on real-life scenarios I have encountered throughout my career.

more insight into the disadvantages by drawing on real-life scenarios I have encountered throughout my career.