Rent vs Buy NYC: Pros & Cons

Go Back To Previous PageIs renting or buying an NYC apartment right for you? This dilemma can be a tricky question to answer, and some experts will be able to argue vigorously and advocate for both sides of the equation. But at the end of the day, it depends on your unique situation. This guide will explore the advantages and disadvantages of renting versus buying a home in NYC. After reading this article, you will be better equipped to decide what’s right for you. Rent vs. Buy NYC: That is the question! We will highlight our rent vs. buy calculator.

- Key Benefits of Renting

- Key Benefits of Buying

- So is Renting or Buying Right for me?

- Rent vs. Buy NYC Calculators

- Renting is great for those who want flexibility.

- Buying is a way to build equity and long-term wealth.

Key Benefits of Renting

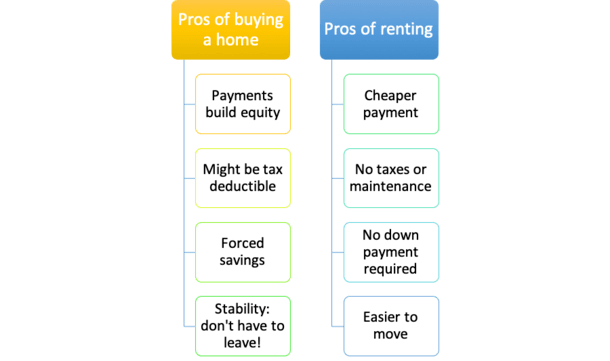

Quite possibly, the most significant advantage of renting a home remains increased flexibility. Many millennials value this flexibility highly, as they prefer to move around more than their parents did. Renting is also a good option if you’re starting a career with much upward mobility and can upgrade your digs as your salary grows.

Another key benefit of renting is lower up-front costs. NYC is notoriously expensive, and Broker fees can be as high as 15%, so you’ll always have lower out-of-pocket costs when renting.

If you want to mitigate your expenses, there are plenty of no-fee apartments in NYC. Also, you can even get a rental rebate on select apartments.

The last significant benefit of renting is that you don’t have to worry about maintenance costs, repairs, property taxes, etc. And in some NYC co-ops, the monthly maintenance fees can be thousands of dollars.

Key Benefits of Buying

Many Americans dream of buying their own home, and there are numerous benefits to buying over renting. The biggest is that  homes typically increase in value, outpacing inflation. Therefore, you’re building equity with each monthly mortgage payment by purchasing a home.

homes typically increase in value, outpacing inflation. Therefore, you’re building equity with each monthly mortgage payment by purchasing a home.

You also enjoy more excellent stability when you buy, as your mortgage payments won’t change with a 30-year fixed-rate mortgage, while your monthly rent can always increase. The NYC real estate market, in particular, tends to be a performing and safe investment, as there’s still strong demand from buyers. Many homeowners also enjoy the greater privacy that comes with owning a home, and owners like the ability to customize the house and make it their own.

Another key benefit is that you have numerous tax benefits when you buy a house, whereas renters get no such tax breaks. Finally, buyers also enjoy pride in ownership.

So is Rent vs. Buy NYC Right for Me?

As mentioned earlier, it generally depends on your situation, but two key factors are the geographic location and the length of time you plan on living in your next home.

living in your next home.

In most cities in the U.S., buying will most likely always make more sense than renting. The argument for buying is even more persuasive in a market with low mortgage rates.

The annual rent of a 2-bedroom apartment in NYC (approx. $40,000) is the down payment of a house almost anywhere outside N.Y. (and California!)

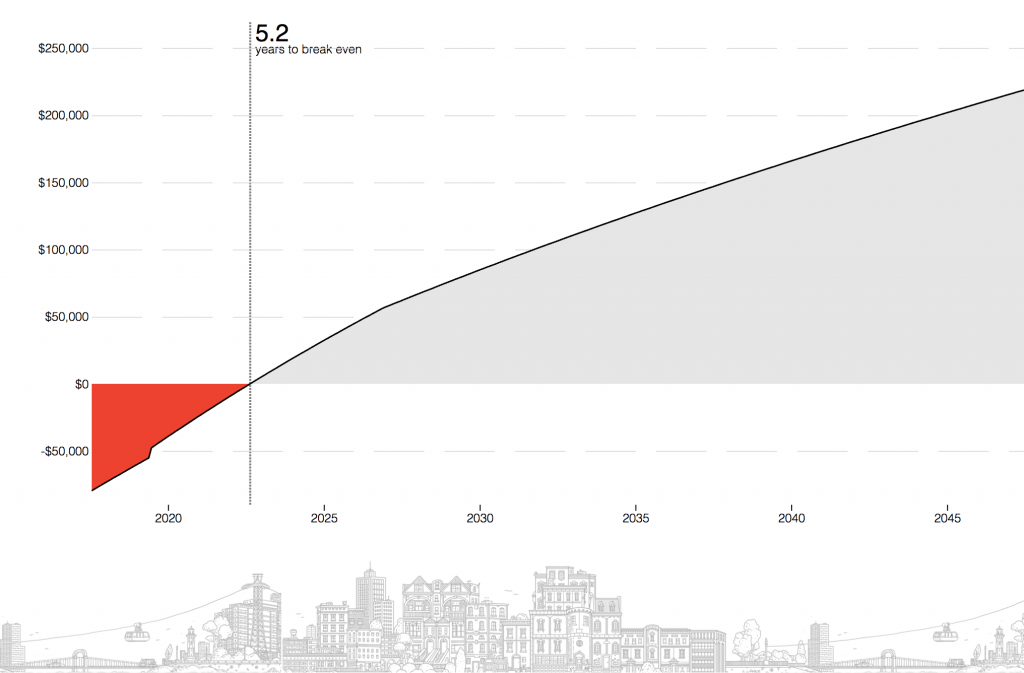

A fundamental concept when discussing buying vs. renting is the tipping point. The tipping point is the amount of time you need to stay in an apartment for it to be economically worthwhile. In other words, if you buy, how long should you stay in that apartment for it to make more sense than renting it?

Rent vs. Buy NYC Calculators

One of the best ways to decide what’s right for you is to do a rent vs. buy analysis to calculate if renting or buying makes more financial sense . Several online tools help you figure that out: Streeteasy offers a very user-friendly formula to guide you depending on neighborhood preference and apartment size.

. Several online tools help you figure that out: Streeteasy offers a very user-friendly formula to guide you depending on neighborhood preference and apartment size.

Brilliant Asset considers your income, marital status, and current rent to give you an accurate response. We also suggest using a mortgage calculator to consider the loan term, purchase price, inflation, credit score, and loan amounts.

Renting is great for those who want flexibility.

If you’re only planning on staying in the city for the short term, the flexibility of renting is hard to beat. Even people who could afford to buy sometimes prefer to rent. The rental market in NYC is enormous and offers so many options that you will always be able to find something you like.

Renting also eliminates maintenance costs, common charges, and real estate taxes; in most cases, your rent will likely be lower than your mortgage payment (principal and interest).

Rent vs. Buy NYC: Buying is a way to build equity and long-term wealth

Buying a home allows you to borrow money. This means you are acquiring an asset with someone else’s money. This is important as the leverage can increase your investment’s return.

For example, if you put down a 20% down payment to purchase a property for $1,000,000 and sell it for a net of $1,200,000 5 years later, your annual rate of return is around 14.87%. On the other hand, if you were to purchase that property with $1,000,000 in cash, your annual rate of return would be about 3.7%.

As you can see, leverage in real estate is powerful.

Assuming you can secure a reasonable mortgage rate, you can also take advantage of tax benefits. In a market as liquid as New York and with a stable appreciation rate, your property will most likely be worth more when you’re ready to sell than when you purchased it.

The most considerable difficulty with buying is coming up with the cash required for the down payment + closing costs. Getting this cash is no small ordeal and remains the most significant limitation for potential buyers. Some purchasers will use private mortgage insurance (PMI).

When you have reached that point, any additional money will be welcomed, and the cash rebate offered by NestApple will help.

Last but not least, if you want to buy at some point but need more time, we suggest a rent-to-own structure, where you rent first with an option to buy later.