1031 Exchange in NYC: 2023 tax benefits guide

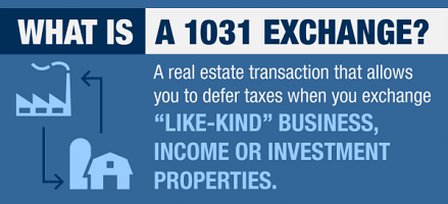

Go Back To Previous Page This post will teach you how to execute a 1031 exchange in N.Y. A 1031 exchange, also known as a “Like-Kind” exchange or a “starker exchange,“ is a formidable tax-deferment strategy savvy real estate investors use in real estate dealings.

This post will teach you how to execute a 1031 exchange in N.Y. A 1031 exchange, also known as a “Like-Kind” exchange or a “starker exchange,“ is a formidable tax-deferment strategy savvy real estate investors use in real estate dealings.

Therefore, if you are considering what a 1031 exchange in NYC is and thinking about executing one, look no further and continue reading!

INTRODUCTION:

What is a 1031 tax-deferred Exchange? Real estate investing can feel overwhelming.

A 1031 Exchange is not a way to reduce real estate taxes but to postpone paying them. Investors can be surprised to hear about the taxes owed when selling. With regular investments like stocks and bonds, you pay capital gains, the difference between your purchase and final sale prices. Unfortunately, there’s much more to consider regarding investment properties.

When investors sell, depreciation recapture is also taxed at higher rates! Not only will you owe capital gains and depreciation recapture, but you could also owe even more for attached items with a faster depreciation schedule.

WHAT IS A 1031 EXCHANGE?

First, let’s break down the name:

First, let’s break down the name:

-

- The term 1031 comes from the IRS tax code, section 1031.

- The “exchange” part comes from taking capital gains from selling a property and investing them in a “like-kind” property without paying taxes on those capital gains.

- Initially, the exchange involved literally trading your property for someone else’s—today, it is called a “simultaneous” exchange. However, not only is that rare, but most 1031 exchanges are “delayed” 1031 exchanges.

However, there are different types of exchanges, so let’s explore another relevant type before tackling the most common—the “delayed exchange.”

“Improvement/Construction Exchange”

This exchange comes in handy when you want to improve an acquired property with the capital gains of your previous property without paying taxes on that money. There are a few rules with this exchange.

- The total exchange equity on the completion of the property by the 180th day

- If you do not spend the money for completed construction by the 180th day, you must have spent the money for a down payment on the property.

Rules of a 1031 (delayed) exchange

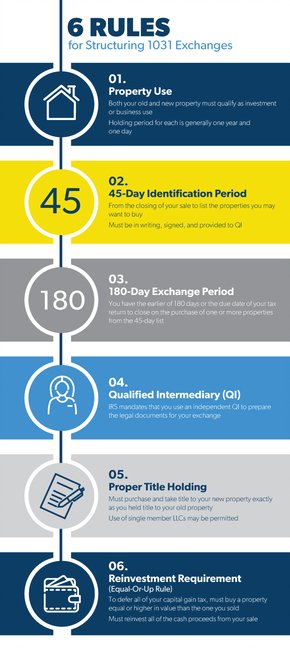

When most people talk about 1031 exchange rules, they talk about a “delayed” exchange. But, like most things, you must follow the rules and regulations to execute 1031 in NYC properly.

1. LIKE-KIND PROPERTY

The property you are putting the capital gains into must be of a “like-kind.” The Internal Revenue Code describes a “like-kind property” as one “of the exact nature, character, or class.

Quality or grade does not matter. Most real estate is like-kind to other real estate. For example, “real property improved with a residential rental house is like-kind to vacant land.”

The IRS’s bottom line is pretty lenient regarding what like-kind property is, as long as it is a property. An important note: All properties must, in the exchange, be U.S. property, not from a foreign country.

2. EQUAL OR GREATER VALUE

If you hope to pay no tax on your capital gains, the IRS demands the (net) market price plus any equity to be the baseline for your next property. For example, let’s say you are selling a $1 million home with a mortgage of $250,000.

The “like-kind” property must be at least $1 million, and you must carry over the $250,000 mortgage. Any brokerage fees and real estate taxes are also factors in this number.

3. INVESTMENT OR BUSINESS PROPERTIES ONLY

This rule is self-explanatory, but it is the one most people get tripped up on. The most common is that you cannot swap primary residences.

Let’s say you own a rental property in Arizona. You can swap that for a vacation house in California (of equal or more excellent value).

4. SAME TITLE NAMES

The relinquished property title names must be the same as those on the acquired replacement property.

5. THE BOOT RULE

Let’s say you want to execute a 1031 exchange in NYC that is of lesser value. “Boot” refers to the difference between relinquished and replaced property. And that difference is taxable.

For example, let’s say you want to sell a $1 million property, but the replaced property is only worth $750,000, and the $250,000 is taxable.

6. THE 45-DAY RULE (IDENTIFICATION RULE)

1031 exchange real estate

The investor has 45 days, calendar, not business, to identify up to three like-kind properties.

You can identify four or more properties if their combined value is less than 200% of the relinquished property value.

7. THE 180-DAY RULE (PURCHASE RULE)

This regulation states that you must complete the purchase in under 180 days or the due date of the tax return for that tax year (with extensions) in which the property was sold, whichever is earlier.

1031 tax-deferred Exchange Example – More Tax Benefits than you think

A fictional investor, “Shayna,” wants to sell her investment property. Ten years ago, she bought a property in Kansas City, MO, for $400,000. Shayna initially allocated $360,000 to the building’s value and $40,000 to the land.

A fictional investor, “Shayna,” wants to sell her investment property. Ten years ago, she bought a property in Kansas City, MO, for $400,000. Shayna initially allocated $360,000 to the building’s value and $40,000 to the land.

The first ten years Shayna has owned the property have been great! It has cash-flowed $200 a month and appreciated a lot. The market value is now approximately $600,000. Even better, Shayna has taken $133,333 in depreciation, which has reduced her income in the eyes of the IRS.

The only bad part is when Shayna goes to sell the property; her accountant says her tax bill is $73,333.25. Shocked, Shayna wonders how this could be when the property only appraises for $200,000. She figured that since it’s a long-term capital gain, the tax rate is (.2*200,000)=$40,000.

Why is the tax higher than expected?

Shayna enjoyed a depreciation-fueled tax break for the past ten years. Now, the IRS wants that money back upon sale. Here’s how the IRS figures this out:

In addition to regular capital gains (Sale Price – Original Price), the IRS says that any depreciation you take makes your “cost basis” lower. Instead of the original cost basis of $400,000, the IRS “cost basis” is $266,667 (Original Price – Depreciation Taken).

In addition to regular capital gains (Sale Price – Original Price), the IRS says that any depreciation you take makes your “cost basis” lower. Instead of the original cost basis of $400,000, the IRS “cost basis” is $266,667 (Original Price – Depreciation Taken).

To add insult to injury, depreciation recapture is taxed at your regular income tax rate, up to 25%.

So when Shayna sells her property, she should be accounting for the capital gain of $200,000, taxed at 20%. Then, she needs to add depreciation of $133,333, taxed at 25%, to this total.

1031 exchange real estate – 1031 exchange timeline

WHEN COULD A 1031 EXCHANGE BENEFIT ME

If you are currently investing in a property you want to sell, this would be perfect for you.

If you are currently investing in a property you want to sell, this would be perfect for you.

Selling a property and putting that money directly back into another investment property without paying taxes saves you money and allows you to invest in a property that may otherwise be beyond your budget.

WHY IS A 1031 EXCHANGE BENEFICIAL IN THE SHORT RUN AND LONG RUN

Executing a 1031 exchange could help you invest in a bigger and better property.

Executing a 1031 exchange could help you invest in a bigger and better property.

These 1031 exchange rules could be even more advantageous in the long run. The more you sell and put your tax-free money back into property investment, the more properties you can invest in.

1031 tax-deferred Exchange Tax Benefits

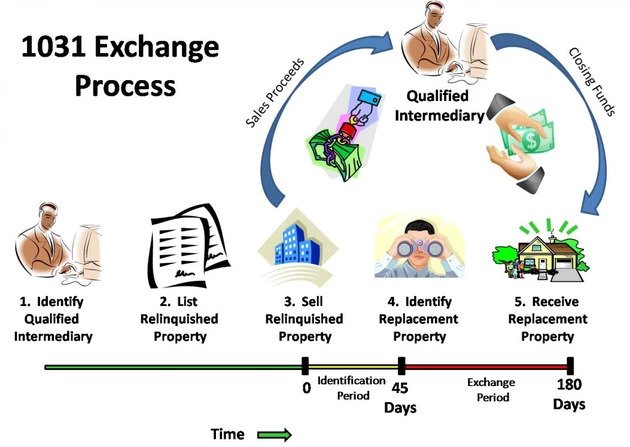

Fortunately, there’s a way to defer paying taxes upon sale, and that’s through the 1031 exchange. You can buy a “replacement property” and not pay a single dime to the IRS by arranging with a qualified intermediary.

Fortunately, there’s a way to defer paying taxes upon sale, and that’s through the 1031 exchange. You can buy a “replacement property” and not pay a single dime to the IRS by arranging with a qualified intermediary.

After identifying the properties, you must close on one of these replacements within 180 days of the sale. Once done, you’ll submit Form 8824 on that year’s taxes. We’ve glossed over several steps, but any reputable 1031 exchange company will help you through them.

HOW TO DO A 1031 EXCHANGE NOW?

If you believe you are ready to sell an investment property and ideally have identified replacement property, hire a professional to explain the 1031 Exchange Tax Benefits: NestApple is here for you, and you will save: