NYC 421a Tax Abatements

Go Back To Previous PageThe world of New York City real estate tax would make an average person’s head spin. Tax laws, in general, are going to be rough to handle. Therefore, the city’s taxes are one of the main reasons people avoid living here. However, there are some fantastic tax abatements you should know about. 421a tax abatements, for example, fit that bill nicely. But, what are they? For instance, NYC 421a tax abatements are a way to lower property tax that New York real estate owners may owe. They count as credits against the current tax owed, and developers who offer affordable housing benefit from it. This tax abatement can be a huge blessing for the right building owner. We will also discuss the 421a tax abatement expiration.

It’s time to talk about what this could mean for you.

What Is A NYC 421a Tax Abatement?

421a tax abatements aren’t just a single decrease. They are a tiered set of abatements that help decrease property tax for building developers working to make more affordable housing in the city. This reduces tax liability and also encourages the making of much-needed affordable housing.

to make more affordable housing in the city. This reduces tax liability and also encourages the making of much-needed affordable housing.

Currently, these are the most common types of tax abatements the city offers.

Therefore, there are almost twice as many buildings with a 421a tax abatement tied to them as there is the following type of abatement. If you snag one of these buildings, you’re in luck.

How Does this Abatement Work?

It’s a tiered and scheduled system. There are currently four different tiers and six different types of schedules for tax abatements.

The tiers matter the most since they tell you how long your abatement is good for. You can have a 10-year, 15-year, 20-year, or 25-year term.

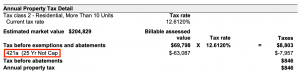

This table shows the terms and the schedules. The schedules refer to how much of the 421a abatement’s benefits you can claim per year.

This goes from 100 percent to fully taxable in increments of 20. Timing matters a lot in your construction benefits.

How Do You Find Out If A Building Has A 421a Tax Abatement?

This is the tricky part. In most cases, there are several ways to find this out.

- Your real estate agent will usually be the first to tell you. This is a huge selling point of many buildings, for all the obvious reasons you can imagine. However, it would be best if you verified this.

- To verify this, check online on the Department of Finance’s website. You can click on “Benefits” and search a property’s address to see if there is an abatement on record.

- Of course, your potential seller may also mention any abatements they have to sweeten the deal. If the agent doesn’t tell you, sellers who want to get their building off the market fast usually will.

Is A 421a Tax Abatement Building A Good Deal?

It could be. It all depends on what price you have to pay. Most of the buildings that have abatements are going to sell at a premium price because of the tax advantages they offer.

You have to run the math to figure out if buying that building will save you money over the long run.

Moreover, it’s important to remember that all abatements eventually end. When they do, you will see a massive increase in your tax bill. If you feel that you may not be able to afford it, it might not be the right deal for you.

What Happens To Your Property After your Abatement Ends?

Another reason you might want to avoid buying these is what happens when that abatement runs out.

With higher tax bills, the premium people were willing to pay for your building will disappear. Of course, this isn’t bad if your building increased in value over 20 years. But if you wanted to flip it in two? It could be an issue.

Are You Ready To Get A 421a Abatement Apartment?

That’s great! At Nest Apple, we make it possible for people to get the buildings they want at a more affordable price. How do we make it happen? Simple—we offer brokerage rebates that make the transaction cheaper for you. Give us a call today.