Buying a New Development in NYC (2018)

Go Back To Previous PageNew development apartments sometimes represent a challenge for buyers. Everything gets brand new, and they often include luxury amenities you can’t find in older buildings. It’s not hard to buy a home. However, buying into a new building development in NYC comes with crucial differences and increased costs compared to a typical “resale” transaction. We wrote you a guide about new housing developments in NYC:

1. What is the definition of “new development” in NYC?

The definition of new development may seem like a simple question, but NYC real estate always finds a way to complicate things. Imagine a vacant lot on which a sponsor builds a tower; that’s a glaring example of new development.

But what about a gut-renovated townhouse? Is that a new development? The NYC Department of Buildings (DOB) has precise rules about when an “alteration” becomes a new building. For example, the DOB will determine the floor area added.

But what about a gut-renovated townhouse? Is that a new development? The NYC Department of Buildings (DOB) has precise rules about when an “alteration” becomes a new building. For example, the DOB will determine the floor area added.

If it increased by more than 110%, it’s a new building. Let’s apply that to the townhouse example above. If they gutted it—removing all the floors, and only the exterior walls remained—it would be considered a new development.

On the other hand, a beautiful renovation that maintained the floors would be an alteration.

Additionally, we use “sponsor” and “developer” interchangeably, referring to the company that owns and develops the project.

2. Why does it matter if a property is a new development?

New housing developments in NYC

Whether a project is considered an “alteration” or a “new development” has significant implications for both sponsors and buyers. A sponsor would always prefer an alteration; if they’re developing a vacant lot, that isn’t possible, but sprucing up an existing structure has significant advantages.

The sponsor must comply with all building codes once a project tips into new development.

Alterations, on the other hand, get grandfathered. The distinction remains less critical for buyers; they purchase the finished product and aren’t concerned with how it was produced. However, buyers have substantial differences regarding the purchase of a new development apartment in NYC.

3. What should you know before buying a new development apartment in NYC?

Before checking out properties, it’s essential to know a few key things. Closing costs can be significantly higher than in a resale transaction. We will delve into the details below, but for now, be aware that closing costs remain approximately 2% higher, primarily due to transfer taxes.

New housing developments in NYC

Agent Representation

If you use a buyer’s agent, make sure they contact the listing agent on your behalf. New projects often have agreements regarding real estate commissions, and it can be challenging to bring in an agent after a few independent viewings.

Timeline

If you’re buying a standard resale apartment, a good rule of thumb is that it’ll take 2-3 months to close. For new development, though, that can be pretty much anything. Projects often start selling before the building is complete, and listings are frequently posted before construction begins.

Buyers usually “buy off the floor plan” with a rough sense of what the sponsor will deliver and when. Even buying while construction is underway exposes you to the risk of a certificate of occupancy delay. However, if the building is completed, you can close fast without board approval.

Financing

Getting a mortgage can be tricky. Many banks require a new building to be at least 51% sold before they’ll lend. For this reason, a “preferred lender” usually exists for the building. The preferred lender becomes familiar with the construction and usually makes loans before that 51% threshold is reached.

While you can use any lender you want, the sponsor often requires you to apply through their preferred lender.

4. Difference between buying a new development vs. resale

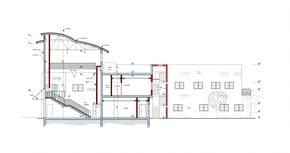

Now that you’ve got a good sense of the costs and timeline, what else should you know? If it is early in the construction process, you won’t be visiting the actual building. New projects usually have an off-site sales office. There, you will see some materials and fixtures that will be used.

Depending on the building, there will be life-size examples of the kitchen and other rooms. As construction wraps up, your visit will be no different than a resale, and you can walk the specific apartment under consideration.

You’ll also usually discover more apartments than are listed online, especially for large buildings. There’s no point in marketing twenty identical one-bedroom units simultaneously, and you can learn about other units that may be available at the sales office.

New development purchases also include an additional walkthrough. Before the usual walkthrough, you’ll have a “punch list” walkthrough, during which you’ll note all the apartment’s defects. During the usual walkthrough, you’ll ensure that the sponsor has made the requested repairs.

5. Questions to ask when making an offer on a new development

You should ask a few questions if you’re considering making an offer. Perhaps most importantly, you will want to know when deliveries will start, especially when construction has just begun.

You can expect typical closing costs, including transfer taxes, the sponsor’s attorney fees, and a working capital contribution. However, there may be other smaller costs that can add up. Every dollar of closing costs increases the price, so you want to ensure you know what you’re getting yourself into.

You can expect typical closing costs, including transfer taxes, the sponsor’s attorney fees, and a working capital contribution. However, there may be other smaller costs that can add up. Every dollar of closing costs increases the price, so you want to ensure you know what you’re getting yourself into.

In the future, you should pay particular attention to property taxes, as they are estimates.

Ask how the unit’s square footage is calculated. The offering plan details this calculation. While condo square footage remains more reliable than co-op square footage, different calculation approaches can yield varying results.

For example, sponsors allocate common areas to individual units, and some sponsors measure the outside of the walls if this information is disclosed. This is one of the many reasons it’s always ideal to compare pricing within a building.

6. The offering plan to buy a new development apartment in NYC

An offering plan details the building and the apartment’s future features, which are delivered to the buyer. It is a legal document and must comply with the Attorney General’s regulations. Your attorney will review the offering plan before you enter a purchase contract.

Apartment items specified in the offering plan include:

- Appliances

- HVAC

- Windows

- Flooring

- Wiring

- Plumbing

Details about the building—such as its façade, roof, and shared amenities—will also be included, including the number of trees to be planted outside. The offering plan is a promise from the sponsor to protect you. For example, if a landscaped roof deck was included in the offering plan, the sponsor could not decide to cut it because it was getting too expensive.

7. How do closing costs differ when buying a new development apartment in NYC

In our post about buyer closing costs, we mention that the bill can easily reach 5% of the purchase price of a new development, which is far more than in a resale transaction. Previously, sponsors worked magic to convince buyers that they should pay the transfer taxes and the sponsor’s attorney fees.

In our post about buyer closing costs, we mention that the bill can easily reach 5% of the purchase price of a new development, which is far more than in a resale transaction. Previously, sponsors worked magic to convince buyers that they should pay the transfer taxes and the sponsor’s attorney fees.

On resales, the seller almost always pays for both. Transfer taxes typically amount to 1.825%, and the sponsor’s attorney’s costs are approximately $2,500, which represents a significant expense.

You’ll also have to contribute to the building’s working capital fund. These come in addition to typical average closing costs, such as the mansion tax, mortgage recording tax, and title insurance.

New development closing costs remain negotiable, though, and most sponsors will be indifferent between a higher price where they pay the transfer taxes and a lower price where the buyer pays.

However, when viewing new development listings online, it is essential to note that the actual asking price remains approximately 2% higher due to these costs.

8. How to save on buying a new development apartment in NYC

If you want to reduce closing costs, check out the cashback commission rebates NestApple offers. You’ll receive part of the commission the listing broker provides, along with an agent to help navigate everything we’ve discussed.

If you want to reduce closing costs, check out the cashback commission rebates NestApple offers. You’ll receive part of the commission the listing broker provides, along with an agent to help navigate everything we’ve discussed.

Most new development purchases will incur a 2% fee of the purchase price. Say goodbye to those transfer taxes!

Buying a New Development Apartment in NYC has many implications, and we hope this guide will help you make a wise real estate purchase.