Tips for NYC Coop Board Package Reference Letter (2025)

August 17, 2025 by Nicole Fishman Benoliel

Go Back To Previous Page

A typical NYC co-op board application requires applicants to submit three to six letters of personal and professional reference. It’s essential to request the Board Package Reference Letter as soon as you have a fully executed purchase contract. To be on the safe side, consider requesting more letters than the required amount, as some of your references may be late in submitting their letters or may not provide the content you would like.

Also, keep in mind that even if you are purchasing a condo in NYC, you may still need to provide reference letters. This article includes sample reference letters—professional, personal, employer, and landlord—specially tailored for NYC co-op applications, along with additional information, tips, and tricks for preparing these letters.

How many reference letters does a typical NYC co-op board application require?

In a typical NYC co-op building, applicants are usually required to submit three to six business or personal reference letters, along with separate landlord and employer reference letters.

The exact requirements can vary depending on the specific co-op building and types of reference letters:

Requirements Vary by Building

Some board applications specify clear guidelines for reference letters (e.g., no family members), while others are more flexible regarding their requirements.

If you’re unsure, it’s always a good idea to ask your buyer’s agent to clarify any specific reference letter requirements directly with the listing agent or managing agent.

Here are a few real examples of the reference letter requirements from the board applications of various co-op buildings in New York City:

Pre-war co-op in Concourse, Bronx

- Three personal reference letters, three professional reference letters, an employment and income verification letter from the current employer stating position, hire date, and income, and a landlord reference letter.

Boutique pre-war co-op located in Chelsea, Manhattan

- Two business or professional reference letters are required, along with two personal reference letters. You will need a reference letter from your current landlord or managing agent, as well as a letter verifying your employment and income.

Requirements for purchasing a unit can vary significantly from building to building. Smaller walk-up buildings or self-managed cooperatives often have more relaxed criteria when it comes to the purchase application and reference letters. If you’re fortunate enough to be buying a sponsor unit, you can avoid the board approval process entirely.

However, even if a complete purchase application and attendance at a coop board interview are not required, you might still need to complete a simplified application for a sponsor sale.

Are reference letters required for both condos and co-ops in NYC, or just co-ops?

While many people believe that only co-op buildings in New York City require purchase applications, several condominium buildings also request that buyers complete one. Typically, the condo board application is less rigorous than that of a comparable co-op building. However, your condo board may still require references and/or letters of reference.

If you are purchasing a co-op apartment directly from a sponsor, it is unlikely that you will need to submit reference letters. Nevertheless, buying a sponsor unit does not guarantee that you won’t have to complete a board application. Even though a co-op may not reject your application for a sponsor unit, they might request an abbreviated board application to verify your assets and conduct credit and criminal background checks.

If you’re buying your neighbor’s apartment, your co-op building will likely still require you to submit an abbreviated board application.

There is a concerning trend where more condominium boards are requesting reference letters and creating board packages that can be as lengthy as those for co-ops.

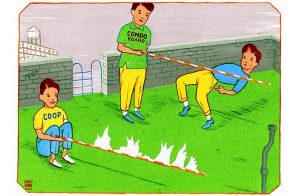

By doing this, condo boards may come across as unreasonable, akin to co-ops that crave power. To avoid such problematic buildings, it’s wise to request a copy of the condo’s purchase application early in the process. You can ask the listing agent for a copy of the application before placing an offer, even though buyers typically receive the application only after they have accepted their offer.

How long should it take to assemble my board application reference letters?

The time you have to request and assemble your reference letters will depend on whether you are financing your purchase or paying all cash. If you are financing the purchase, you’ll have a bit more time because you’ll need to wait for your mortgage commitment letter before submitting your application.

Typically, receiving a commitment letter from your bank takes about 3 to 5 weeks.

Request Reference Letters as Soon as Possible

If you are making an all-cash purchase, you can submit your overall board application much more quickly since you don’t need to wait for a mortgage commitment letter.

Regardless of whether you are financing or paying in cash, it’s advisable to request your reference letters as soon as you have a fully executed contract and have received the co-op’s financial requirements.

Consider requesting more than the minimum number of reference letters. This helps mitigate the risk of delays or potential issues with a less-than-stellar reference from any individual. Lastly, please note that your purchase contract may require you to submit the board application within a specified number of days after receiving your mortgage commitment letter.

What is the length of a NYC coop reference letter?

There is no strict requirement for the length of a co-op reference letter. However, a board package reference letter should be between three paragraphs and a page and a half in length. Reference letters that are shorter than three paragraphs may be subject to additional scrutiny. Those that are too long might lose their effectiveness.

Ultimately, reference letters should be both insightful and concise. Prioritize quality over quantity when determining the appropriate length of a reference letter.

What should be included in a personal co-op reference letter?

The primary purpose of the co-op reference letters you submit is to help the board gain a qualitative understanding of you as a person and how you would interact with and contribute to the co-op community.

- When choosing individuals to provide personal references, consider including the following content in their letters:

- Please describe how you met the candidate, how long you have known them, and the reasons for your friendship.

- Detail the nature of your interactions with the candidate. What activities and events have you experienced together based on shared interests? Examples include theater, sports, charities, a previous workplace, professional associations, or travel. Were you or they ever guests in each other’s homes?

- Specify the candidate’s defining character traits, providing examples to support descriptions such as “responsible,” “trustworthy,” “honest,” and “ethical.”

- Mention the candidate’s educational background and any academic or personal achievements you are aware of.

- If you have experience living in a co-op or serving on the board, include this information to enhance your credibility with the board.

- Identify personal attributes of the candidate that would make them a good neighbor in the co-op.

What should be included in a professional co-op reference letter?

A typical NYC co-op purchase application will require 1 to 4 professional business reference letters for each applicant.

The content of a business reference letter should cover the following points:

- Describe how you know the candidate professionally. Include details such as how you met, how long you’ve known each other, and the nature of your professional relationship.

- Candidate Qualifications: Highlight the qualities that enable the candidate to excel in their role. For example, mention if they are leaders, team players, visionaries, or if they maintain a positive attitude in the workplace.

- Achievements. Provide insight into the candidate’s accomplishments at work and what they have achieved during your association.

- If you have experience living in a co-op (either in NYC or elsewhere), discuss the personal attributes of the candidate that would make them a good neighbor in the co-op community.

What is a landlord reference letter?

The purpose of a landlord reference letter is to verify that you have consistently paid your rent on time and in full.

A typical landlord reference letter should include the following details: the address of the rental unit, the duration of the tenancy, and the amount of rent paid. It should also indicate whether you have been punctual with your rent payments.

Suppose your co-op purchase application does not specify what should be included in the landlord reference letter. In that case, we recommend providing as much detail as possible, including all of the items mentioned above.

What if my landlord is a friend or family member?

Even if your landlord is a friend or family member, it shouldn’t affect your co-op board application.

If you are renting from a friend or family member, ask them to provide a letter that includes the following details: the property’s address, the duration of your stay, the amount of rent you pay, and whether you consistently pay your rent on time.

If you are living rent-free, request a letter from a friend or family member that states your address, the duration of your stay, and confirms that you are not paying any rent. This letter would be similar to a signed gift letter you would obtain if a family member were helping you with a down payment for a mortgage.

What is an employer reference letter?

An employer reference letter is distinct from the professional reference letters we discussed earlier.

The primary purpose of an employer reference letter is to verify factual information, such as your place of employment, dates of employment, the amount and nature of your compensation, and specifics regarding your current role or position.

Contact Human Resources

Since an employer reference letter provides non-qualitative data about your relationship with the company, it is usually issued by the Human Resources (HR) department. Therefore, the easiest way to obtain an employer reference letter is to request one from your HR contact. If you work for a small firm without a dedicated HR department, you should ask someone who can confirm the details of your employment.

Additionally, your mortgage banker or broker will need to verify your employment through a phone call, typically occurring two days before closing. A representative from your bank will call the phone number you provided for your employer to confirm verbally that you are, in fact, still employed.

This process can become problematic if fired or laid off before closing. Depending on how well your lawyer has protected your interests in your purchase contract, you might still be able to recover your contract deposit.

How do I provide an employer reference letter if I’m self-employed?

If you are self-employed, it is essential to request professional reference letters from individuals with whom you have worked in a professional capacity. Additionally, if you do not have a traditional employer, a typical NYC co-op board package will require some extra financial verification items beyond the standard REBNY financial statement, bank statements, and bank verification letters.

These additional items may include a notarized letter from your accountant, profit and loss statements from your business, and/or the operating agreements or formation documents for any legal entities through which you conduct business.

What if I don’t have enough people to ask for reference letters?

As a co-op candidate in New York City, it’s crucial to follow the board application instructions carefully and submit a complete board package on your first attempt. If you submit fewer references than required, the managing agent will reject your application and return it to your buyer’s agent for corrections, meaning the board won’t have the opportunity to review it.

Contact the Managing Agent

If you believe you lack sufficient people to provide references, consider asking your buyer’s agent to confirm the specific requirements for reference letters with the building’s managing agent.

There is a possibility that reference letters from family members may be acceptable, and the board might only require one set of reference letters for both you and your significant other, rather than separate sets for each of you.

Do co-op reference letters require original signatures, or are copies acceptable?

Whether you need to submit original reference letters with ink signatures depends on the specific requirements of your building’s purchase application. When the board package instructions specify “original” reference letters, your references will need to mail you the signed original letters.

Suppose the application does not specify a requirement for original letters. In that case, it’s advisable to have your buyer’s agent confirm the specific requirements with the managing agent before submitting the board package.

Suppose you have requested a NYC buyer agent commission rebate and are working with an experienced buyer’s agent. In that case, they will take the initiative to collect and assemble all necessary original documentation from you and the seller.

Suppose you are selling your property as a For Sale By Owner (FSBO) in NYC, and an agent does not represent your buyer. In that case, you will need to take the lead in reviewing your buyer’s board application and coordinating the collection of all original documents.

What are some general tips for preparing NYC co-op reference letters?

The purpose of reference letters is to highlight your positive qualities and enhance your overall candidacy for the co-op position. However, poorly written reference letters can significantly weaken your application.

When requesting your reference letters, consider the following guidelines:

- Please include Contact Information: Always provide the reference’s contact details in the letter, including their email, phone number, and address.

- Maintain Consistent Formatting: Ensure that each reference letter’s format is similar to the example letters provided.

- Avoid Plagiarism: Be cautious of fake or plagiarized letters. If you provide your references with a template or sample letter, make sure they do not copy any part of it word-for-word. Submitting similar letters raises a red flag for the board, and they will be vigilant about this.

- Check for Grammar and Spelling: Ensure that grammar and spelling are flawless in each letter.

- Review for Accuracy and Consistency: Read through the reference letters to check for any inaccuracies or discrepancies.