Mortgage Contingency Clause in NYC (2018)

October 25, 2018 by Nicole Fishman Benoliel

Go Back To Previous Page

Simply put, a mortgage contingency clause in NYC real estate ensures the following: Say a buyer wants to buy a home and applies for a loan from a bank. If the buyer fails to obtain a firm commitment for a mortgage within the specified period, they may cancel the contract. Then, the buyer receives the return of the initial down payment, his earnest money deposit.

We are happy to share mortgage contingency clause samples and examples. Buyers misunderstand the financing contingency. Therefore, this concept is a rather broad term for a contract contingency. It includes many negotiable parts, such as an appraisal contingency or a minimum loan amount contingency.

Sellers & buyers often inquire about the meaning of the “mortgage contingency clause” in New York real estate contracts.

Don’t confuse the “commitment letter“ with the “pre-approval letter.” A pre-approval letter is typically non-binding and carries little legal weight. A bank issues it before conducting a more detailed investigation of the borrower and the property.

Don’t confuse the “commitment letter“ with the “pre-approval letter.” A pre-approval letter is typically non-binding and carries little legal weight. A bank issues it before conducting a more detailed investigation of the borrower and the property.

There is often a great deal of confusion about whether a mortgage contingency clause is “necessary.”

There is often a great deal of confusion about whether a mortgage contingency clause is “necessary.”

The conventional explanation given is that buyers should request the clause. It provides them with added protection when applying for financing. At the same time, sellers will push to avoid the mortgage Contingency Clause. This may result in delays due to the buyer’s loan approval process.

Additional delays can occur if the first buyer is unable to secure financing and exercises the mortgage contingency clause. In that case, the seller must find a new buyer to purchase the home.

The financing contingency is a purchase agreement contingency; it only takes effect after a listing is “in contract” and legally binding. The financing contingency protects the buyer after the purchase contract is executed.

A mortgage contingency provides the buyer with a way out of the contract if they cannot secure a commitment letter within a specified contingency period (typically 30 to 45 days after the property is “in contract”).

Is a mortgage contingency necessary?

Whether a mortgage contingency clause in NYC is “necessary” depends on several factors, including:

- The financial status of the buyer.

- The appraised value of the unit for sale.

- In the case of co-ops and condos, the financial viability of the cooperative or condo community of which the unit is a part.

- Overall real estate market conditions (e.g., buyers’, sellers’, and lenders’ markets).

For example, a relatively wealthy individual buying a co-op unit applies for a mortgage. The unit appraises below the contract price, and its financial condition does not meet the bank’s underwriters’ requirements. In this case, the bank may deny the buyer a mortgage. Conversely, a person with relatively minor wealth might be approved to buy a condo that appraises high in a financially solid building.

For example, a relatively wealthy individual buying a co-op unit applies for a mortgage. The unit appraises below the contract price, and its financial condition does not meet the bank’s underwriters’ requirements. In this case, the bank may deny the buyer a mortgage. Conversely, a person with relatively minor wealth might be approved to buy a condo that appraises high in a financially solid building.

In either case, the overall real estate market conditions may result in a different reality. For example, in a “seller’s market,” a seller has prospective buyers banging down the door with offers well above the asking price.

That seller will have little incentive to agree to a mortgage contingency. However, in a “buyer’s market,” the same seller might have no option but to include the contingency or lose a potential buyer.

Why do sellers in NYC disapprove of mortgage contingency clauses?

Sellers in NYC are often averse to deals with mortgage-contingent buyers because there are usually many buyers to choose from.

In a strong housing market, a seller may receive multiple offers. This means there is a significant ‘opportunity cost’ and risk for the seller to choose the mortgage contingent offer over an all-cash offer. This can happen even if the financed buyer’s offer price is marginally higher.

A seller signs a contract with a buyer who is mortgage-contingent. The clause is ultimately activated, the deal falls apart, and the seller has lost 30-60 days of precious marketing time.

How can I minimize my risk if I’ve decided to submit a non-contingent offer?

Assuming you are pre-approved by a major bank and have confirmed that your building is on the list of approved buildings, you will most likely get approved.

If the bank has approved you but not your building, they should be able to tell you whether or not the building gets approved before you commit to signing the contract.

There are options if you are competing against an all-cash and/or non-contingent offer, but are unwilling to forego the entire mortgage contingency. You can break down the contingency into several components to manage risk effectively while making your offer as competitive as possible.

As a sweetener to the seller, you could agree to cover the financial risk of a low appraisal. Do this only if you have a backup plan for making up the shortfall (which we discuss in more depth below).

There is no “standard” clause, although several standard clauses are circulating throughout the industry.

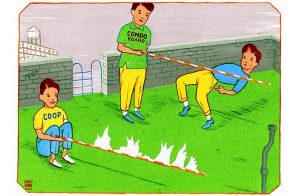

Some Mortgage Contingency Clauses act like protective bubbles surrounding the buyer for a time.

Some Mortgage Contingency Clauses act like protective bubbles surrounding the buyer for a time.

Then, once meeting certain conditions, they “pop” and disappear altogether. Other clauses act more like shields that guard the buyer against certain situations throughout the contract process.

It is possible to find a compromise that satisfies the buyer’s need for financial protection while reassuring the seller that the contingency period will be brief.

This concept is a rather broad term that attorneys can negotiate. For example, the buyer’s attorney can negotiate the inclusion of minimum loan amount language. This clause allows the buyer to cancel the contract if he can’t secure financing for a negotiated threshold. Another angle is to include an appraisal contingency.

This clause allows the buyer to cancel the contract and withdraw from the deal if the appraisal falls below a certain threshold (typically the contract price minus a few percentage points).

Therefore, we strongly recommend that prospective buyers and sellers consult with their attorneys regarding this Mortgage Contingency Clause.

Consult about negotiating a deal from acceptance to signing the contract to closing. It is straightforward to request samples and examples of mortgage contingency clauses from your attorney.

Don’t confuse the “

Don’t confuse the “ There is often a great deal of confusion about whether a mortgage contingency clause is “necessary.”

There is often a great deal of confusion about whether a mortgage contingency clause is “necessary.” For example, a relatively wealthy individual buying a

For example, a relatively wealthy individual buying a  Some Mortgage Contingency Clauses act like protective bubbles surrounding the buyer for a time.

Some Mortgage Contingency Clauses act like protective bubbles surrounding the buyer for a time.