What is “post closing liquidity” in NYC Co-ops? (2018)

Go Back To Previous Page Several concepts are essential to understand when buying an apartment in New York. Calculating Coop post-closing liquidity for a mortgage in NYC is one of them. In summary, it means: after closing, how much money will you have available? It would be helpful if you had more than just a down payment to buy a co-op in New York City. When purchasing a co-op in NYC, you must meet the building’s post-closing liquidity and debt-to-income ratio requirements. Many co-ops have specific needs, while others take a holistic approach to evaluating a buyer’s financial situation. This information will be presented in your board package before scheduling an interview.

Several concepts are essential to understand when buying an apartment in New York. Calculating Coop post-closing liquidity for a mortgage in NYC is one of them. In summary, it means: after closing, how much money will you have available? It would be helpful if you had more than just a down payment to buy a co-op in New York City. When purchasing a co-op in NYC, you must meet the building’s post-closing liquidity and debt-to-income ratio requirements. Many co-ops have specific needs, while others take a holistic approach to evaluating a buyer’s financial situation. This information will be presented in your board package before scheduling an interview.

What is post-closing liquidity?

It means the amount of liquid funds a buyer will have after closing on their home. Buyers should consider their liquid assets after paying the down payment and closing costs. To arrive at this number, it would be helpful to review your finances and total assets. Then, subtract the down payment plus any other closing costs involved.

The final amount will show your available cash on hand.

In other words, Coop post-closing (post-close) liquidity forecasts how many months’ worth of apartment carrying costs you will have readily available in liquid assets after you close on your apartment.

What post-closing liquidity do Co-Ops require?

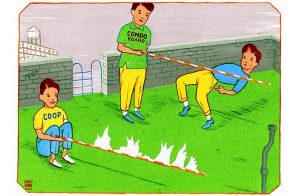

This concept becomes particularly relevant when purchasing a co-op. Condos do not require a specific amount of cash if you plan to get a mortgage. However, your lender will likely take this figure into account.

This means that regardless of the type of property you are buying, you will need to put some cash aside if you plan to finance it.

Generally, co-op boards require 24 months of liquidity for your mortgage and maintenance payments after closing. As a result, you should aim to have 24 months of cash or cash equivalents after closing.

Some buildings require even more. For example, if a buyer has 24 months of post-closing liquidity, they have enough liquid assets to pay the monthly co-op maintenance and mortgage bills for 24 consecutive months.

Why do I need it?

It is beneficial to have a safety net in place in case you encounter financial difficulties. Hopefully, it will help you sleep better at night. Co-op boards aim to minimize distressed sales, as they can harm comparables in the building.

Lenders want to ensure that you can repay the borrowed funds, even in the event of an unexpected and unfortunate occurrence.

What Is Considered Liquid Assets?

An asset is liquid if it can be converted to cash in a day or two. Buyers frequently ask us about their life insurance. According to this definition, the cash surrender value of your life insurance plan would generally be included in the calculation, but the death benefit would not be included. The definition of “liquid assets” is open to interpretation and varies among co-op boards.

- Liquid Assets:

- Petty Cash and Cash Equivalents (CDs)

- Short-term Money Market Funds

- Government Bills and Bonds

- Stocks and Bonds, mutual funds

- Vested Stocks and Options

- Illiquid Assets:

- Unvested 401K, IRA, SEP IRA, Roth IRA

- Pension and Keogh Plans

- Life Insurance

- Personal Property and Real Estate

- Unvested Shares or Deferred Compensation

Like many aspects of real estate in New York, the definition of liquid assets will vary by building. Some co-ops are more flexible and will allow you to include your 401 (k), life insurance, and other retirement funds. Unfortunately, other co-ops (and this is becoming a trend) will require all liquidity to be in cash or cash equivalents.

The latter includes bonds, stocks, and other securities. Not having enough available cash post-closing is one of the top reasons a board might reject you. Even if the managing agent doesn’t share the building’s financial requirements, your buyer’s agent may still be able to determine which types of assets the Board will count as ‘liquid assets.’

What is the formula for post-closing liquidity in NYC?

There is no unique way to calculate Coop’s post-closing liquidity. When preparing your REBNY financial statement, NestApple will assess your post-closing liquidity for each property you are interested in to determine whether you are qualified to pass the co-op board. We will factor in the monthly maintenance, assessments, mortgage payments, and property taxes for your other properties.

We usually take (Liquid Assets – Down Payment – Estimated Closing Costs) divided by (Monthly Mortgage P&I + Maintenance + Assessments + Homeowners Insurance)

You can use a mortgage calculator to get the monthly mortgage payments based on the interest rate, maturity, type of mortgage, and loan amount.

What is the typical rule for co-ops in NYC?

It is typically two years’ worth of carrying costs, and most co-op boards require a two-year term. They want to ensure you have sufficient funds to cover mortgage payments, maintenance, and taxes.

Therefore, they will meticulously analyze this number. Before submitting an offer on a co-op, it’s essential to have your buyer’s agent confirm the co-op’s financial requirements. If a building does not specify its post-closing liquidity requirements, a conservative rule of thumb is to have at least two years of post-closing liquidity.

We have done deals in which the Board requested that we put some extra money into an escrow account because the buyers’ post-closing liquidity was too tight.

To conclude, you can add your NestApple cash rebate to your formula and meet the threshold for post-closing liquidity.

Do Banks Require Post-Closing Liquidity?

Your lender also wants to make sure you have a reserve.

Depending on the bank, they typically require assurance that you have sufficient liquidity to cover at least one year of mortgage payments and monthly maintenance fees after paying the down payment and closing costs.

After all, if you do not have anything saved up in a rainy day fund, you could face a potential foreclosure if something happens, such as a job loss. Therefore, while your condo may not require you to have a reserve fund, the bank will almost surely want to see one.

Your lender will likely allow this money, such as a gift from a relative, to come from elsewhere. However, a bank will want to ensure you have some post-closing liquidity and meet its other requirements, such as its debt-to-income ratio.