What Are Closing Costs, And Why Do You Have To Pay Them?

Go Back To Previous PageWhen you’re trying to buy a home, the actual price of the house is only one of many things you must pay. You may already be aware of the fees related to inspections and expenses that your real estate agent may incur. However, one of the more nebulous terms you’ll hear is the “closing cost” of a real estate transaction. What exactly are those costs, and why do they matter? Where can I find a closing cost calculator? This is trickier than buying BNB.

related to inspections and expenses that your real estate agent may incur. However, one of the more nebulous terms you’ll hear is the “closing cost” of a real estate transaction. What exactly are those costs, and why do they matter? Where can I find a closing cost calculator? This is trickier than buying BNB.

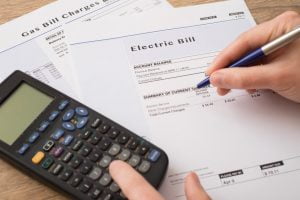

Closing costs refer to the additional taxes and fees paid during a real estate transaction. These costs include attorney’s fees, appraisal fees, mortgage fees, and title fees. For the transaction to proceed, buyers and sellers must cover these costs.

Those costs represent as much as 10 percent of your home’s value, making them a significant expense you must consider.

What Types of Fees Are Involved in Closing Costs?

There are various fees associated with the transaction. These include (but are not limited to):

- Mortgage and title insurance

- Appraisal fees

- Legal fees

- Title fees

- Paperwork fees

- Mansion taxes

- Title transfer taxes

- Real estate commissions

Who Pays For Closing Costs?

Both buyers and sellers must contribute to closing costs.

Traditionally, buyers must handle the mansion tax, mortgage recording tax, mortgage insurance, and title insurance. Additionally, sellers are required to pay transfer taxes and real estate agent commissions.

Any additional fees may be required to pass the title to the buyer successfully.

Can You Negotiate Who Pays Closing Costs?

One of the most attractive aspects of real estate is that everything is negotiable, including matters such as closing costs. If you want to persuade a buyer or seller to assume more of the costs, it is possible.

All you must do is discuss the matter with your real estate agent, and they can help facilitate these talks with tact.

Is It Possible To Avoid Closing Costs?

Sadly, most people must pay closing costs for their real estate deals. It’s just the way things are. However, you can avoid some of its fees if you know how to do so.

For example, buying a property under $1 million will help you skirt the mansion tax. Additionally, purchasing an FSBO may result in reduced real estate agent commissions.

Even so, all homes in NYC will require attorneys’ fees as part of the title transfer fee, and you can say the same about certain taxes and insurance policies.

What Can You Do If You Can’t Afford The Closing Costs?

Let’s say you have the money for a home but don’t have enough to afford the closing costs. Does this mean “game over?” Not quite, and you may still be able to push things through. Here’s what you can do:

- Negotiate some of the costs. This may make it possible for you to get the house you want as a buyer. Sellers must be motivated (and generous) to do so, but they may still do it. Sellers can cover costs by raising the asking price.

- Pare down any closing costs you can. Get a cheaper home. Obtaining an appraisal waiver, although risky, can help bring you back into the realm of affordability.

- Get a Purchase CEMA. A CEMA is a Consolidation Extension Modification Agreement, which means you’re assuming the loan of the old homeowners. You will then have the opportunity to refinance it, tailoring the loan to your specific needs and abilities. This helps you avoid paying most, if not all, closing costs.

- Consider asking for help with your closing costs through New York City’s HUD. New York City offers various programs that can make home ownership more accessible, including down payment assistance and help with covering those costs. You can learn more by checking out NYC’s HUD Site.

Before You Put In An Offer, Ask About Closing Costs

It may seem like you can afford that brand-new home initially, but if you’re short on cash, you may need to reconsider your options. You have a real estate agent and brokerage that works with your budget matters here.

If you’re concerned about affording closing costs, it may be time to consult a broker who understands your situation. We’re here to help.