Your 2025 guide to Mortgages in New York City

Go Back To Previous PageWhen you purchase real estate in New York City, you must borrow money from a lender and obtain a “mortgage loan” in NYC. This is unless you have a lot of cash in the bank and are incredibly wealthy. Getting a mortgage from a mortgage bank in NYC puts what’s called a “mortgage lien” (the right to take possession) on the property. The lien remains in place until the buyer pays the loan in full. This includes paying back the original amount borrowed (“principal”) and the interest. Interest is simply the amount the bank charges to borrow money. This blog post will write about all sorts of mortgages and help you minimize your average monthly mortgage payment in NYC.

Interest rates on mortgages in NYC are much lower than on other types of loans. However, mortgage loans are for substantial sums borrowed over extended periods. Therefore, the total amount of interest paid is significant. Sometimes, the interest rate and the mortgage term’s length represent more than the principal amount before the borrower pays the loan in full.

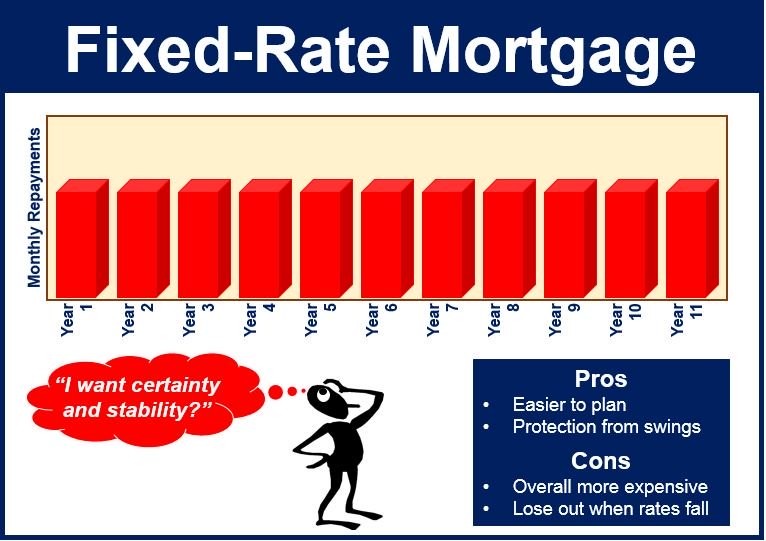

Fixed-Rate Mortgages in NYC

A fixed-rate mortgage means that the interest and average monthly mortgage payments in NYC remain the same throughout the loan’s life. The mortgage is paid in full or “fully amortized,” provided you have complied with the loan terms. For fixed-rate mortgage loans, the percentage of your monthly payments applied to principal and interest changes over time.

A fixed-rate mortgage means that the interest and average monthly mortgage payments in NYC remain the same throughout the loan’s life. The mortgage is paid in full or “fully amortized,” provided you have complied with the loan terms. For fixed-rate mortgage loans, the percentage of your monthly payments applied to principal and interest changes over time.

In other words, as you pay off the principal, the amount that goes to interest is lower. Also, the amount that goes to the principal is higher.

As such, the loan will be wholly paid off at the end of the loan term. With this type of loan, making additional payments will reduce the principal amount faster, reducing the time the buyer will take to repay the loan.

Offering a home as collateral for a loan is becoming increasingly popular among Americans. Although mortgage loans are considered the most popular type of loan secured by the house, other alternatives exist.

Home equity loan vs. mortgage? Which option is more suitable for you? It is crucial to consider your purpose and all the benefits and drawbacks of both types of loans before deciding.

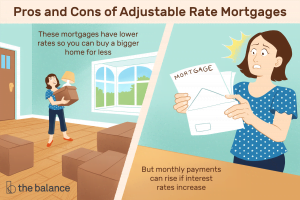

Adjustable-rate mortgages (“ARM”) Mortgages in NYC

An adjustable-rate mortgage (ARM) is a mortgage for which the interest rate can change throughout the loan’s life. There are several ways an ARM gets built, and the mortgage note will lay out the mortgage terms.

Overall, the interest rate for an ARM is tied to an index. The index could be the federal treasury bond rate or other national rates. However, it’s important to remember that the lender has no control over the index. In any event, as the index changes, so does the borrower’s rate.

All ARM loans are subject to two limits: an annual cap and a ceiling.

The annual cap limits how high the interest rate can increase yearly. For example, an ARM may say it can grow by only 2 percent annually.

An ARM is also subject to a lifetime ceiling or cap. This caps the interest rate’s rise, regardless of the index’s rise. For example, the buyer starts with a total rate of 5 percent, and the lifetime cap is also 5 percent. That means the highest rate can amount to 10 percent, no matter how high the index rises.

ARM became unpopular after the 2008 housing crash.

However, an ARM mortgage represents a good idea for some buyers, especially homebuyers who don’t expect to live in their homes for 30 years. For example, imagine an ARM mortgage loan with a fixed rate for the first five years. The buyer can then take advantage of the lower interest rate and pay the loan like a thirty-year mortgage to build up equity faster. If the buyer sells the property at the end of the five years, they will have more equity.

As a result, they will make a more substantial profit at closing. Overall, borrowing on a 30-year term to finance a home you plan to live in for just five or ten years means the buyer will pay thousands of dollars more in interest. As a result, the buyer will have less equity in their house when they sell it.

Lastly, there is always a chance the interest rate can decrease at the end of the five years, and the borrower can refinance the loan into a more favorable term.

Balloon Mortgage

A balloon mortgage loan is where a portion of each average monthly mortgage payment in NYC pays off the principal and the interest. However, at the end of the loan, the borrower will not pay the principal amount in full. As such, the buyer must make a large payment (“balloon payment”) to satisfy the loan.

One advantage of these loans is that the interest rates are typically low, making the monthly payments more affordable. As an obvious downside, the buyer must plan or save to afford to pay off the balance when it becomes due. While rare, some buyers use this loan to buy a house in NYC.

Interest-only mortgage

An interest-only mortgage in NYC is a loan in which the buyer only pays off the loan’s interest. Frequently, loan payments are relatively low and manageable for first-time home buyers. This interest-only option typically lasts less than ten years.

When the 10-year term is up, the buyer can refinance into a new standard loan or renew the interest-only loan.

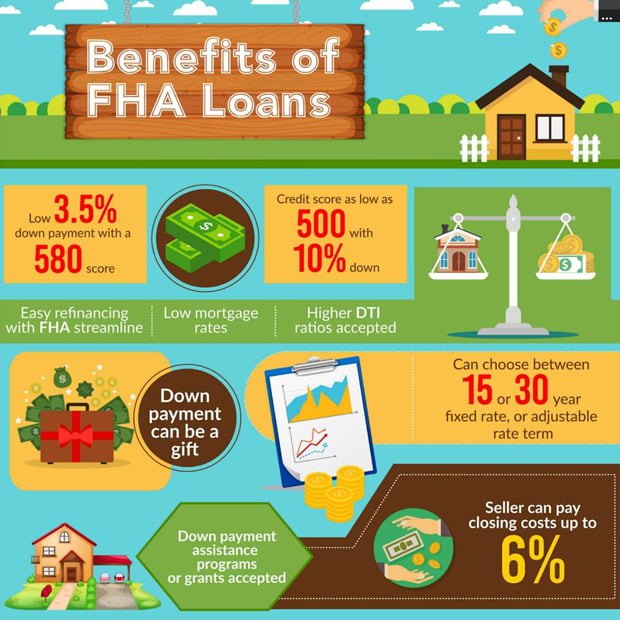

FHA loans

The Federal Housing Administration (FHA) is a government agency under the supervision of the US Department of Housing and Urban Development. It’s important to note that the FHA does not directly make loans. Instead, the agency insures loans that primary lenders make.

Although the FHA offers several programs, the 203(b) loan is the most commonly used. The name “203(b)” refers to the law’s section that governs such loans.

A property must be owner-occupied or a one-to-four-family house to qualify for an FHA loan. That means that co-ops do not qualify for FHA loans. You can buy a condo with an FHA loan, but only a few are FHA-approved in New York City. Down payments can be as low as 1.25 percent for lower-priced homes and up to 3.5% for higher-priced homes.

The downside to FHA-backed loans is their high loan-to-value (LTV) ratio. If the buyer puts in less than a 20% down payment, he must also pay a mortgage insurance premium (MIP) at closing. This fee remains based on a percentage of the loans.

Therefore, the program also requires that an FHA-approved appraiser estimate the property’s value. Nevertheless, mortgage banks in NYC may not charge a prepayment penalty for an FHA loan.

Mortgage in NYC: SONYMA loans

For buyers who qualify based on their family’s income level, the State of New York Mortgage Agency (SONYMA) offers a few mortgage programs explicitly designed to help first-time homebuyers purchase homes.

SONYMA’s programs are often desirable and feature competitive interest rates (currently 3.5%). They also require a 3% down payment, have flexible underwriting guidelines, have no prepayment penalties, and offer down payment assistance.

To qualify for a SONYMA loan as a first-time homebuyer, you must not have owned your primary residence in the last three years. You should also meet the income limits, which vary per county throughout New York State.

Additionally, purchase price limits make finding a Manhattan property that qualifies virtually impossible.

One benefit of this type of loan is that your credit does not determine the interest. However, we recommend having good credit. Instead, the interest rate is the same for everyone. Lastly, even though the program allows a 3% down payment, it doesn’t matter if the coop board requires the typical 20% to 30%.

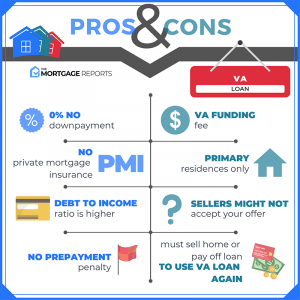

Mortgage in NYC: VA loans

The Department of Veterans Affairs (VA) provides its loan guarantee program to eligible veterans and their spouses. The primary mortgage banks in NYC make the loans, and the VA guarantees all or part of the loan if the borrower defaults.

With a VA loan, the VA sets the rules regarding eligibility. Generally, these types of loans may require little or no down payment. There is no purchase price limit when obtaining a VA loan.

However, the VA will limit the amount of loan it will guarantee.

The buyer may pay the cash difference if the loan represents an amount beyond what the VA loan will ensure. Owner-occupied, one-to-four-family dwellings, including mobile homes, are eligible for VA loans.

To receive a VA loan, you must have a Certificate of Reasonable Value (CRV) from an approved appraiser. The CRV determines the loan amount the VA will guarantee. Mortgage banks in NYC do not permit prepayment penalties with VA loans, but some charge a funding fee to the borrower during the process.

CEMA mortgages

A CEMA loan is not a type of mortgage but rather a way to avoid paying New York State mortgage taxes for those who are refinancing. In some cases, buyers use it to purchase a new property. CEMA is short for Consolidation, Extension, and Modification Agreement. It is most commonly used by homeowners who want to refinance.

Buyers will only need to pay the mortgage recording tax on the difference between the new and old loans. This can result in significant savings. In rare cases, buyers use CEMAs when purchasing a property, but the seller must agree to it and own an existing mortgage.

CEMA loans are only available on conventional, jumbo, and FHA mortgages for condos, houses, and townhouses. VA loans are not eligible and don’t apply to co-ops. They are not real property.