The guarantor isn’t responsible for your loan payments

It’s important to understand that the guarantor is only responsible for covering your co-op’s monthly maintenance fees. This means that the guarantor is not a co-borrower on your mortgage and will not be responsible for making payments to the bank on your behalf.

This arrangement can actually benefit the guarantor because it does not impact their borrowing capacity, particularly regarding the loan payments associated with your apartment appearing on their credit profile.

Who are guarantors usually?

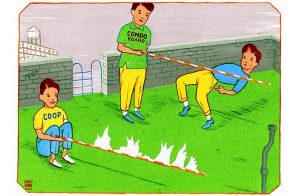

Being a guarantor entails significant responsibility, as it means taking on the obligation to cover your monthly co-op maintenance payments if you cannot. If you fail to pay these charges, your guarantor will be responsible for making the payments on your behalf.

Typically, the individuals willing to assume this burden are parents or relatives who are buying on behalf of their children or other family members.

Moreover, guarantors must be financially qualified to ensure they fulfill their role effectively. This usually means they need to provide the co-op board with financial documentation to demonstrate a stable annual income, typically exceeding 40 times the monthly maintenance fees.

While guarantors generally won’t need to submit a complete co-op board package, they can expect to undergo financial scrutiny. They should be prepared to provide tax returns, pay stubs, bank statements, and potentially a REBNY Financial Statement for the co-op board’s review.

own.

own.