Sample NYC Coop Lien Search

Cooperative Apartment Lien Search, Certification, and Report

Certification Page

Effective date: [Date Issued]

Certified to: [Purchaser Name]

Copy sent to: [Purchaser’s and Seller’s Lawyers]

Borrower / Purchaser : [Purchaser Name]

Owner / Seller : [Seller Name]

Cooperative apartment building premises (“Premises”):

– Address :

– County :

– City :

– Block :

– Lot :

– Apartment / Unit :

Fee title to Premises: [Cooperative Corporation Name]

– By deed from :

– Dated :

– Recorded :

[Title Search Company] certifies that the above-listed searches have been made of public records in the county specified above concerning the following name(s): [Purchaser Name]; [Cooperative Corporation Name]; [Seller Name]

Searches Made

Searches Returns

UCC Financing Statements

– County* 0

– State 0

Federal Tax Liens

– County 0

– State 0

Judgments / NY Tax Liens 0

Bankruptcies 0

Mechanics’ Liens 0

Lis Pendens 0

Patriot Act (OFAC) 0

Mortgages on Premises Enclosed

Mortgages on Units 0

*Returns include only those UCC’s that affect both the names searched and the referenced Premises.

Cooperative Apartment Lien Search – Mortgages on Premises

Subordinate Mortgage held of record by: [Sample Lender Name]

Mortgagor: [Cooperative Corporation Name]

Amount of lien: $X,000,000

Pursuant to: Mortgage recorded 2/15/1995 in Reel 1231 Page 2219

Consolidated mortgages held of record by:

Mortgagor: [Cooperative Corporation Name]

Amount of consolidated lien: $ 3,900,000

Pursuant to: Consolidation, Modification and Extension Agreement recorded 9/21/1995 in Reel 1231 Page 3516

Mortgages consolidated: Reel 245 Page 1924; Reel 1066 Page 1776; Reel 1588 Page 1945;

Assignment of Leases & Rents held by: New York Sample Bank

Assignor: [Cooperative Corporation Name]

Pursuant to: Assignment of Leases and Rents recorded 8/15/1995 in Reel 1929 Page 1111.

Mortgage held of record by: [Sample Private or Public Lender Name]

Mortgagor: [Cooperative Corporation Name]

Amount of lien: $ 590,000

Pursuant to: Mortgage recorded 1/14/1998 in Reel 1666 Page 1492, as assigned in Reel 2549 Page 1066, recorded 9/11/2001.

Assignment of Leases & Rents held by: [Sample Private or Public Lender Name]

Assignor: [Cooperative Corporation Name]

Pursuant to: Assignment of Leases and Rents recorded 1/14/1998 in Reel 2541 Page 1666, as assigned in Reel 3540 Page 1241.

When purchasing an apartment, part of your research should involve ensuring that no one has a claim on it due to debts associated with the building or unit (also known as a lien), or any open permits or building code violations.

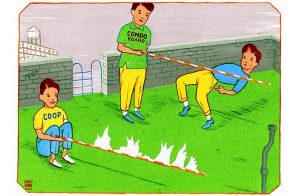

The process for doing this varies depending on whether you are buying a condominium (condo) or a cooperative (co-op).

If you’re buying a condo, you will often be required to purchase title insurance, which protects you against third-party claims.

As a shareholder in a co-op, you will still need to conduct due diligence. However, because the structure of a co-op purchase differs, title insurance is not typically part of the process.

The good news for co-op buyers is that this can lower your closing costs.

Instead of title insurance, you will need to perform a co-op lien search.

A title company can conduct lien searches to determine if any open mortgages, liens, or judgments may “encumber the co-op shares,” according to Lauren T. Piechocki, a real estate attorney with Braverman Greenspun.

For instance, it’s essential to verify that the seller paid off his mortgage, ensuring that the shares and lease are no longer collateral for that mortgage. “Co-op purchasers have the option to obtain policies similar to title insurance, known as bonds or leasehold policies, but these are usually only acquired under special circumstances or when specifically required by the co-op board,” says Piechocki.

It’s also possible for liens to be misfiled due to errors during the lien recording process.

Some recording issues may be more complicated to resolve than others, but a good first step is to contact the entity that recorded the lien.

Piechocki notes, “The party who recorded the lien typically has the authority to correct mistakes in their filing.”

Bottom line

A title company can conduct lien searches to identify any existing mortgages, liens, or judgments that could “encumber the co-op shares,” according to Lauren T. Piechocki, a real estate attorney at Braverman Greenspun.

For instance, it’s essential to have your attorney verify that the seller paid off his mortgage. Therefore, this ensures that the shares and lease are no longer used as collateral for the seller’s previous mortgage.

Liens can sometimes be misfiled, often due to errors made during the recording process. While some recording issues are more complex to resolve than others, a good first step is to contact the individual or entity that initially recorded the lien. The party that recorded the lien usually has the authority to correct mistakes in its filing.

contractor on the seller’s apartment, which technically places a lien on the seller’s co-op shares.

contractor on the seller’s apartment, which technically places a lien on the seller’s co-op shares.