Cost Of Living In Spring, TX [2024]

Go Back To Previous PageSpring, Texas, a charming suburb of Houston, offers a blend of urban and suburban living. The cost of living in Spring, TX, is slightly higher than the state average but lower than the national average in the United States. When considering a move to or residing in Spring, TX, it’s essential to understand the various factors that contribute to its living expenses. This article will delve into the detailed aspects of the cost of living in Spring, TX, providing potential residents with a comprehensive financial overview of what to expect.

Housing Costs in Spring, TX

We expect the housing market in Spring, TX, to be vibrant and dynamic in 2024. The median home listing price is approximately $349,000, around $152 per square foot.

These figures represent a significant year-over-year increase, reflecting a growing market that could appeal to buyers and investors.

Homes in Spring are selling close to their asking price, with a sale-to-list ratio of around 99.02%. This indicates a market where single-family homes are valued fairly consistently at their listing prices. The market is a buyer’s market, with homes staying on the market for an average of 53 days before sale.

The overall sentiment about housing in Spring, TX, is cautiously optimistic despite broader national concerns about economic uncertainty that might impact buyer demand.

Experts predict varying trends for the housing market in 2024, with some suggesting potential price adjustments because of these broader economic factors. However, Spring’s market has demonstrated resilience, with consistent buyer interest and a balanced supply-demand scenario that supports stable property values.

Spring is an intriguing area for potential homebuyers or real estate investors in suburban Houston.

Utility Costs in Spring, TX

In Spring, TX, residents face relatively high utility costs, particularly electricity. Electricity bills average around $204 per month, approximately 12% higher than the national average. This higher rate is primarily due to the average electric rate in Spring being 14 cents per kilowatt-hour, with residents using an average of 1,509 kWh per month.

higher rate is primarily due to the average electric rate in Spring being 14 cents per kilowatt-hour, with residents using an average of 1,509 kWh per month.

Additionally, the region’s reliance on free energy allows residents to choose from various providers, which could offer opportunities to save on these costs through competitive pricing and energy-saving options.

Natural gas prices in Spring also tend to be higher than the national average. As of the end of 2023, the price for natural gas was about $15.01 per thousand cubic feet, significantly higher than the U.S. average.

This price decrease is evident compared to previous months, indicating some fluctuation in pricing trends throughout the year. Despite these costs, opportunities exist for energy savings, primarily through the use of renewable energy sources, such as solar power.

The local solar energy potential suggests substantial long-term savings for those who invest in solar systems, thanks to the area’s high levels of solar radiation.

Transportation Expenses in Spring, TX

Transportation expenses in Spring, TX, are influenced by several factors, including the cost of vehicle ownership and the cost of public transportation. According to data, the cost of a new Volkswagen Golf, a typical vehicle choice, is around $28,120. For daily commuting, gasoline prices are relatively modest, costing approximately $0.82 per liter.

Public transportation offers a more economical option with monthly tickets priced at about $70, providing an affordable alternative for daily commutes.

The University of Texas at Austin also provides insights into students’ transportation costs, indicating the broader expenses residents might face. They estimate transportation costs at approximately $1,740 annually for students living on or off campus, or with their parents.

This figure gives a valuable benchmark for budgeting typical travel expenses within the area, encompassing costs from daily commutes to occasional long-distance travel. Such costs are essential when planning personal finances, especially for those new to the area or considering moving to Spring, TX.

Taxation in Spring, TX

Spring, TX, residents are subject to the tax regulations enforced by Harris County and the state of Texas. Texas does not impose a state income tax, resulting in significant savings for residents compared to other states. However, property taxes in Harris County are a notable aspect of the fiscal landscape.

Homeowners in Spring, TX, must be aware of critical dates, such as January 31, the deadline for paying property taxes without incurring penalties. Starting February 1, penalties and interest accrue on unpaid property taxes.

Texas also levies sales tax. The base state rate is 6.25%, and local jurisdictions can add up to 2%, resulting in a maximum possible sales tax rate of 8.25%.

This is relevant for residents as they budget for daily expenses and large purchases. Managing these taxation obligations efficiently is crucial for financial planning, especially considering the various exemptions and payment plans available for qualifying residents, such as those over 65 or with disabilities, which can alleviate some of the financial burdens associated with property taxes.

Retirement Living in Spring, TX

Retirement living in Spring, TX, offers a diverse range of options that cater to various needs and preferences, blending independence with supportive care when needed. Even if you don’t currently reside there, with the assistance of Spring Texas movers, you can quickly relocate to enjoy your retirement in this vibrant area. Notable communities such as The Landing at Augusta Woods and The Village at Gleannloch Farms provide comprehensive amenities.

These include spacious accommodations, physical therapy facilities, and active social environments essential for a fulfilling retirement lifestyle. They ensure that residents enjoy a high quality of life with services tailored to their specific senior living needs.

For those seeking an active retirement, facilities like The Conservatory at Champion Forest and Paradise Springs offer an upscale experience.

Amenities include well-appointed dining areas, fitness centers, and a schedule of social activities to keep residents engaged and physically active. These communities also offer varying levels of care to ensure that each resident receives personalized attention tailored to their specific health needs.

Additionally, with amenities such as libraries, game rooms, and arts and crafts studios, these establishments strive to meet their residents’ intellectual and recreational needs, making Spring, TX, an attractive option for retirement.

Weather Impact on Expenses

Weather patterns significantly influence expenses in Spring, TX, mainly through their impact on heating, cooling, and storm-related costs. As the region transitions from a La Niña to an ENSO-neutral state in early 2024, residents can expect warmer and drier conditions typical of a La Niña winter to persist into Spring. This shift could reduce heating costs during the cooler months. Still, higher temperatures may increase cooling expenses earlier in the season.

Furthermore, the likelihood of severe weather events, including hail and tornadoes, remains elevated during the Spring, leading to higher insurance premiums and potential storm damage repairs.

Additionally, forecasts for Spring 2024 suggest an overall warmer-than-normal season across much of the U.S., including Texas. This trend could lead to an earlier use of air conditioning, potentially increasing electricity bills.

The weather is also expected to bring mixed patterns, with some areas experiencing below-normal rainfall, which could impact water utility costs and lawn care expenses. The warmer temperatures might benefit those who garden or spend time outdoors, reducing heating costs but possibly increasing water usage for yard maintenance during drier periods.

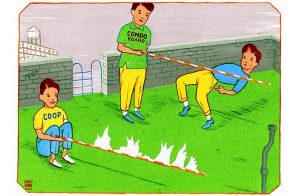

Safety and Crime Rates

In Spring, TX, the overall safety and crime rates indicate a moderately safe community compared to state and national averages. Spring ranks in the 65th percentile for safety, meaning it is safer than 35% of cities, with a crime rate of 23.91 per 1,000 residents annually, according to the Bureau of Labor Statistics.

This places it lower than the average U.S. city in terms of crime rate, suggesting a generally safe environment. The city experiences a varied distribution of crime across different neighborhoods. The northeast parts of Spring are typically considered the safest, while the southwest areas have higher crime rates.

Violent crime rates in Spring are modest at 2.209 incidents per 1,000 residents, which is favorable compared to broader regional and national statistics. Property crimes, although more frequent than violent crimes, remain within a moderate range, with Spring being safer than many other cities of a similar size.

The local law enforcement and community programs likely contribute to maintaining these moderate crime levels, making Spring a safe place to live, work, and raise a family.

Future Projections for Spring, TX

The future projections for Spring, TX, particularly in the housing market, suggest a landscape of moderate growth and stability. The regional housing market, closely tied to Houston’s dynamics, shows signs of continued activity and modest price appreciation.

For example, in the Houston area, which influences Spring, there has been an uptick in home sales and a slight increase in home values, indicating a resilient market likely to sustain its momentum into 2024 and beyond.

This growth is supported by a solid economic backdrop and a steady influx of new listings, which helps balance demand. However, the broader Texas market, including Spring, faces challenges such as rising interest mortgage rates and a tight housing supply, which could temper growth.

Statewide, while some areas may experience a slight dip in home prices due to economic pressures, the market is expected to remain competitive overall, with potential price increases in specific segments. Buyers and investors should consider these factors and regional dynamics when making decisions, as areas like Spring will likely mirror these broader trends.

The market conditions and economic conditions suggest a continued seller’s advantage, although buyers might find opportunities as new listings increase and market pressures adjust.