2025 Guide to Net Effective Rent Before You Sign a Lease

Go Back To Previous PageAre you looking to rent a new apartment and have concerns about your monthly rent? If you need a short break from paying rent, you may benefit from a lease period that does not require you to pay every month. Some leases provide a way out of paying for a month or two. However, the lease will likely include complex terms like gross and net effective rent.

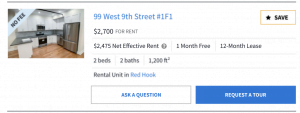

If you’ve ever looked for an apartment in New York City, you may have noticed some rental listings advertised at a net effective rent. These listings typically mention a “free month’s rent” or another non-traditional lease term.

What do these terms mean? Keep reading to find out the definitions and differences between the two and how to calculate your net effective rent.

What Is Gross Rent?

Gross rent is the flat amount you will pay monthly to cover the lease period in your rental agreement.

Landlords may also add other costs to the gross rent, such as utility or maintenance fees. Often, landlords will also use the gross rent to determine whether you can afford the apartment over the long term.

What Is Net Effective Rent?

It is the discounted monthly amount you could pay if you don’t remove the free months entirely from the equation. Generally, the net effective rent is lower than the gross rent whenever landlords provide a discounted rate, and that discount must include one or more months of free rent.

Often, you’ll see a lease with the first and last month free, and this type of discount attracts more renters.

Why Is Net Effective Rent Advertised?

With housing prices in New York so steep, landlords often have to find creative ways to attract tenants. One strategy includes offering a free month if the tenant agrees to sign for a certain period. For example, many landlords will offer one free month on a 13-month lease, meaning you get to stay in the apartment for a free month after paying rent for the entire year.

certain period. For example, many landlords will offer one free month on a 13-month lease, meaning you get to stay in the apartment for a free month after paying rent for the entire year.

These leases are typically advertised at the net effective rent, which means the price reflects the savings of that additional month. This is a common practice as it helps a property owner attract more tenants and can help rent a vacant unit out quickly without having to offer a lower rent payment that might be harder to increase after the first year. It is a great marketing tool for landlords and their real estate agents.

The Differences Between Net Effective and Gross Rent

The most significant difference between net and gross rent is that gross rent is usually more important. Gross rent focuses only on the paid months. In contrast, net effective rent is divided between all the months during the leasing period.

How to Calculate Net Effective Rent

A net effective rent consists of subtracting the free rental months from the lease period and multiplying that value by the gross rent. Then, you can divide the amount by the lease length. This is our net effective rent calculator.

- For example, you’ve signed a 12-month residential lease agreement and rental application, including a free month for $2,500.

- Your gross rent is $2,500, which you multiply by 11 months to get $27,500 (the amount of rent paid).

- To get your net effective rent, you divide $27,500 (the total gross rent paid) by 12 (the entire lease term, including the last month, which is free). and get $2,307.69

However, you would still cut a check for $2500 each month, except for the final month of the lease, which is free.

Tips for Long-Term Renters Before Signing a Lease

The following essential tips will benefit you before you agree to a new apartment lease.

1. Understand the Renewal Terms

Find out the exact gross rent amount you pay before you renew your lease. Renewal terms often exclude discounts or free months in the future. The critical thing to understand about net effective rent is that it represents a temporary rental amount likely to increase once your free rent promotions expire. If you’re planning on moving

At the end of your lease, it’s worth signing a deal with lower net effective rent, thanks to a promotion like a month of free rent.

At the end of your lease, it’s worth signing a deal with lower net effective rent, thanks to a promotion like a month of free rent.

On the other hand, if you plan on renewing your lease agreement, be prepared to pay significantly more long-term, as your actual monthly rent payment will be much higher than your net rent.

2. Read the Lease Before Signing

Pay attention before you sign any contract. Please read the print, and make sure it includes the discounts your landlord promised.

3. Determine the Type of Rent Before Agreeing to a Lease Period

While some places advertise the net effective rent, other apartments include the gross rent. You must know what to pay monthly before agreeing to a particular lease.

Wrap Up

The net effective rent is a way to determine how much a tenant will pay for their apartment after considering all of the discounts and freebies they receive from the landlord. By understanding how it works, you can be sure you get the best deal possible on your next apartment.

With this knowledge, you can confidently negotiate with landlords under landlord-tenant laws and ensure you get the best value for your money. Now that you know the difference between net effective rent and gross rent, it’s time to pick that perfect apartment, sign the lease, and start your new life!