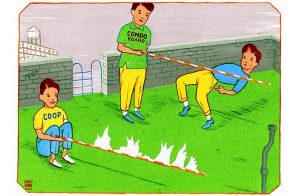

In New York City, landlords generally hold the upper hand, even during periods of softer market conditions. As a result, it is typically the landlord’s attorney who prepares the initial draft of the lease agreement.

The landlord’s attorney may use various standard forms (such as those from REBNY, Blumberg, or the NY Bar Association); however, they will always include a lease rider that is usually much longer.

For example, a standard form lease may be 7 to 10 pages long, while the lease rider can range from 40 to 45 pages and often overrides the terms stated in the standard form. Some landlords have developed their own customized lease forms over time, which may eliminate the need for a separate rider. Unlike residential sales, it is rare for a commercial tenant to have their rider. Landlords often reject most tenant requests to change or edit a commercial lease.

This is traditionally because New York courts tend to favor tenants, so landlords mitigate this risk by using stringent leases with language strongly in their favor. However, larger and more significant tenants—such as universities, anchor tenants, and national chains—tend to have greater negotiating power. Despite the rise of office-sharing startups like WeWork and the decline in demand for commercial real estate driven by e-commerce, landlords in NYC have not become more flexible.

The increasing number of vacant storefronts means that landlords can afford to wait for the next desirable brand-name tenant to come along.

Note that in the 1980s, the average space allocation was 450 square feet per person, whereas today it has decreased to only 135 to 150 square feet per person, despite the rise of internet competition.

upon. Although a Letter of Intent is not a legally binding document, it serves as a summary of the agreed-upon terms that real estate lawyers will use to draft the binding purchase contracts or lease agreements.

upon. Although a Letter of Intent is not a legally binding document, it serves as a summary of the agreed-upon terms that real estate lawyers will use to draft the binding purchase contracts or lease agreements.